Get Out Of Debt

Say “Goodbye” to Debt Once and For All

Dealing with debt? You’re not alone. In fact, over 80% of Americans are currently in debt.

GreenPath Financial Wellness is on a mission to change that. We’ve helped hundreds of thousands of people just like you pay off their debt, save more, and achieve their financial goals.

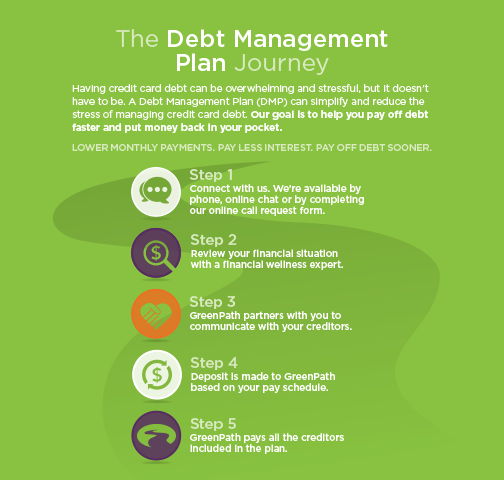

If you have credit card debt or other high-interest loans, you may be able to reduce your interest rate AND pay off your debt faster under a GreenPath Debt Management Plan (DMP).

One Client’s Experience

Here is what one of our clients said about their experience with a GreenPath DMP:

“Being with GreenPath changed our lives, our family structure, our future. We both look at money and income in a completely different way and budgeting has become a full-time lifestyle so that we never, ever get in that postion again…I feel confident that we will be able to provide a stress-free household for our marriage and for our children because we’re not drowning any longer and never will be again.” —Tammy, Colorado

Compare for Yourself

Use our debt payoff calculator to see how much you could save under a DMP. If it looks like we may be able to save you money, simply fill out our call request form and one of our counselors will be in touch within 48 hours. You can also call us at 877-337-3399 to speak with one of our team members today – it’s completely free, 100% confidential and no pressure. Let’s create a plan to pay off your debt.

Call Request Form

Fill out the form below and one of our advisors will give you a call within 48 business hours. Note: If you are a current GreenPath client, click here to access our online portal or call 866-476-7284 to speak with a member of our client success team.