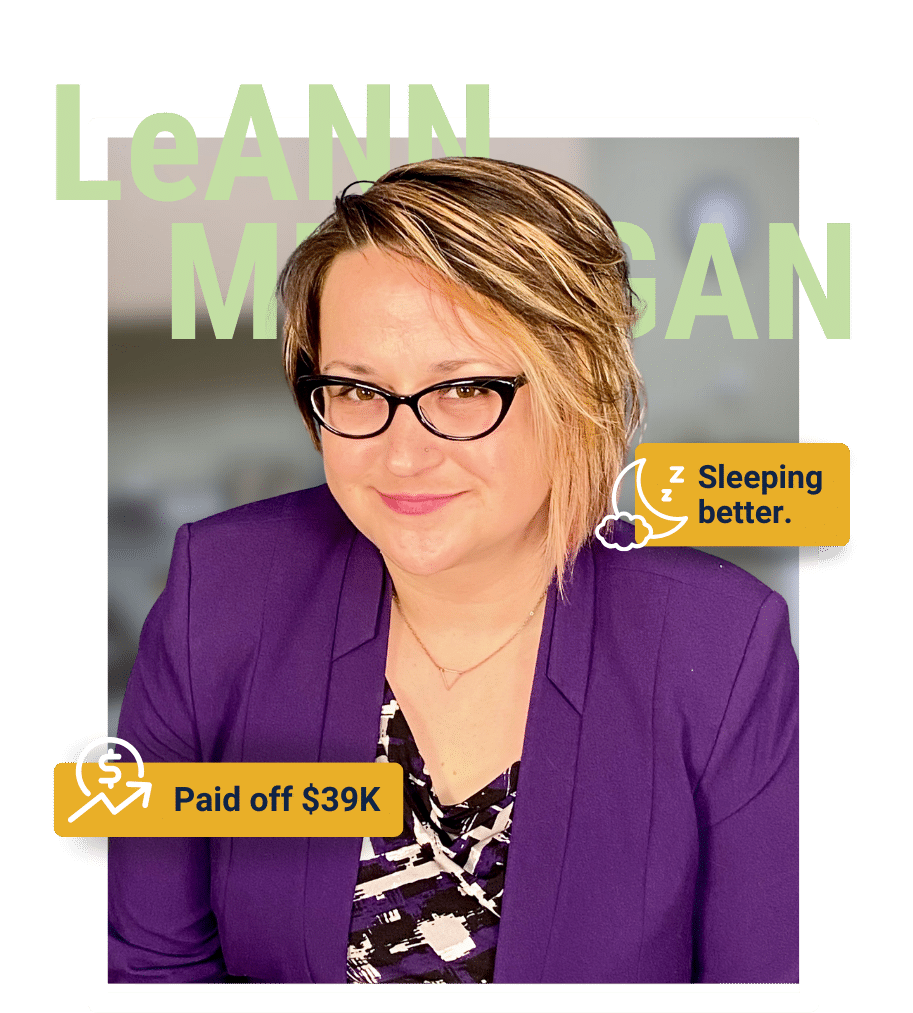

GreenPath helped me regain financial independence.

LeAnn paid off $39k in credit card debt. See how a DMP helped LeAnn sleep better and save for the future.

Financial Counseling Services

GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

Manage Debt

Most of us have debt. Get the support and tools to manage it. See the power of a plan that addresses your financial concerns and empowers you to live a financially healthy life.

Make Housing Decisions

Facing foreclosure, looking for rental counseling, considering a reverse mortgage or home purchase? HUD-certified counselors provide trusted support to handle housing challenges.

Improve Your Financial Picture

Select from a variety of free resources to guide you on your financial journey. Articles, tools, webinars and classes set you up to make informed decisions about your finances.

A Debt Management Program Can Help You Become Debt Free Faster

With the Debt Management Program from the national nonprofit GreenPath Financial Wellness, you become debt free faster. We put 60 years of trusted experience negotiating with major creditors to work, saving you time and money with debt management options tailored just for you. When it comes to debt, you’re not alone.

Client Stories

In the Media

Over 100K

GreenPath provided a total of 107,641 services in 2023

$170M+

was paid through GreenPath towards debts on DMPs in 2023

Nearly 9K

people paid their debts in full with the assistance of a DMP in 2023

Frequently Asked Questions

Is financial counseling free?

Yes. Generally financial counseling, including credit counseling and debt counseling are free. Some of our specialized services for reverse mortgage and home-buyer assistance have a fee.

How long does a counseling session take?

The first general counseling session takes about an hour, although it will depend on your unique situation and what you need to accomplish your goals.

Do I need to make an appointment?

No appointment is needed to talk to a counselor by phone. Use the “Request a Call” form, or call us 866-648-8117 to talk to the Client Services team.

What if I don't have time for a counseling session right now?

No problem! We can complete as much as you have time for, and finish up at a more convenient time. You can also schedule an appointment to be called when you will be available.

What do I need for my initial session?

One of the first things a counselor will do with you is put together your budget. Having an idea of your income and expenses is helpful, but not required.

Will you keep my information confidential?

All client information is secure and confidential. GreenPath will not share your information with anyone without your permission. We also do not report to credit bureaus. Take a look at our Privacy Statement for more details.

Partnerships

Let’s build a financial system that works for everyone. Partner with us to empower financial wellness to those you serve.

Let’s talk