Common Budgeting Mistakes

- May 30, 2017

- Category: Budgeting, Financial Education

Sticking to your budget is easier if you avoid these budgeting mistakes. Don’t use your credit to make ends meet. Make sure to keep track of your expenses.

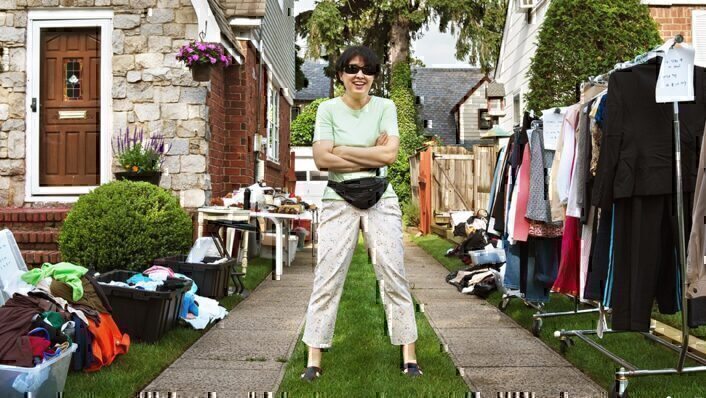

Liquidating Assets

You may want to sell some of your stuff to help pay down your debts. Liquidating assets means selling anything that can be sold or converted into cash.

Consequences of Filing for Bankruptcy: What Nobody Told You

The consequences of filing for bankruptcy can affect you into the future. Learn about what happens when you file for bankruptcy.

10 Ways to Rebuild Credit

Everyone faces setbacks from time to time. The good news is that you can rebuild your credit score. Please understand that there are no quick fixes for improving your scoreimproving your score. You may have seen ads for companies that promise, for a fee, to quickly repair your score. Credit repair does not work. Their usual...

Contacting Your Creditors

Are you struggling to pay your bills each month? If so, you may want to contact your creditors. They may have options for you.

Debt Consolidation Loans

In general, a debt consolidation loan can be defined as a loan that combines multiple debt obligations into one single and simplified loan.

6 Tips for Going Green at Home From a GreenPath Counselor

Going green at home is easier than you think. We have discovered some quick and easy ways to make a difference in our budget and the environment.

Bankruptcy Process & Timeline

- April 6, 2017

- Category: Bankruptcy, Financial Education

The Bankruptcy process means accepting a legal status where you are unable to pay your debts. Before you choose bankruptcy, talk to an attorney.

Beware of Scams!

It’s tax season and this is the time of year that IRS scams and fraudulent tax filings are on the rise. At GreenPath, we want you to beware of scams. Here are some suggestions to avoid becoming a victim: Threat 1 An adversary calls or emails you and portrays him or herself as an employee with the IRS. Their purpose...

Showing results 361-369 out of 433