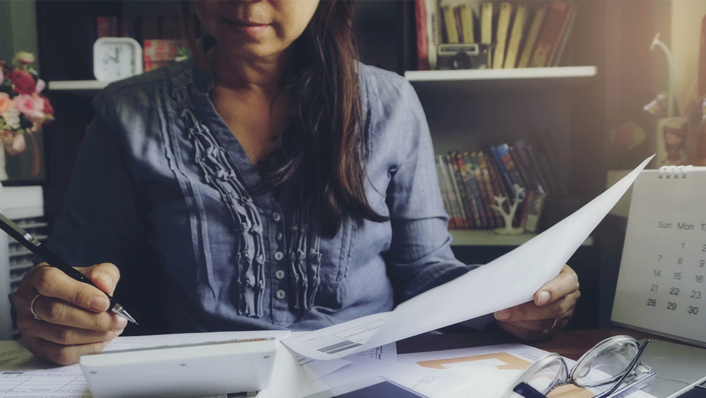

GreenPath helped me regain financial independence.

LeAnn paid off $39k in credit card debt. See how a DMP helped LeAnn sleep better and save for the future.

Financial Counseling Services

GreenPath is a trusted national nonprofit since 1961. Through our partnership, everyone who contacts GreenPath receives a free financial counseling session. Let’s make your financial goals happen, together.

Pay Down Debt

Faster

A debt management plan could help you to lower your interest rates and pay off debt faster. Learn more.

Improve

Credit Score

Get a free credit review from GreenPath’s financial wellness experts. Learn more.

Make Housing

Decisions

GreenPath can help you make informed decisions about your housing choices. Learn more.

Free Financial Resources

Debt Calculator

Enter your current balance below to see how much you can potentially save.

Worksheets & Guides

From setting a budget to improving your credit score, get actionable steps for making progress toward your financial goals. Learn More

Online Financial Courses

GreenPath LearningLab+ is a free online financial education portal offers users easy-to-use financial educational experiences. Learn More

Client Stories

Tanisha & Noah

"The engagement with the GreenPath debt counselor,

it was genuine."

Nichelle

“It was a giant weight off my shoulders. Because the debt has followed me and it's been this giant shadow.”

Frequently Asked Questions

Is financial counseling free?

Yes. General financial counseling, including credit counseling, debt counseling are free. Some of our specialized services for reverse mortgage and homebuyer assistance have a fee.

How long does a counseling session take?

The first general financial counseling session takes about an hour, although it will depend on your unique situation and what you need to accomplish your goals.

What do I need for my initial session?

One of the first things a counselor will do with you is put together your budget. Having an idea of your income and expenses is helpful. If you have billing statements handy, even better!

Will you keep my information confidential?

All client information is secure and confidential. GreenPath will not share your information with anyone without your permission. We also do not report to credit bureaus. Request your free counseling session.

Speak with A Counselor About Your Debt Options Today

GreenPath have helped more than 65,000 households pay off over $200 million in debt. You can call GreenPath anytime during business hours to reach a debt counselor if you need advice.

Contact a GreenPath counselor today for a free debt counseling session. 100% confidential. Call 877-337-3399 today.

Take the First Step It Is Free and 100% Confidential

Contact GreenPath to conduct a free debt counseling session to see if our debt management plan is right for you.

NOTE: This is an example. It helps you see how a debt management plan might help you. IT IS NOT AN ACTUAL QUOTE.

How Your Debt Is Calculated

- The pay “on your own” example assumes you make only the minimum payment.

- We use an interest rate of 24 percent. The GreenPath debt management plan example shown is based on getting rid of your debt within five years.

- We use an average interest rate of 8 percent .

In most cases, we can work with your creditors to reduce your interest rate. Actual interest rates will vary by client and creditor.