Campaign: Life After Debt

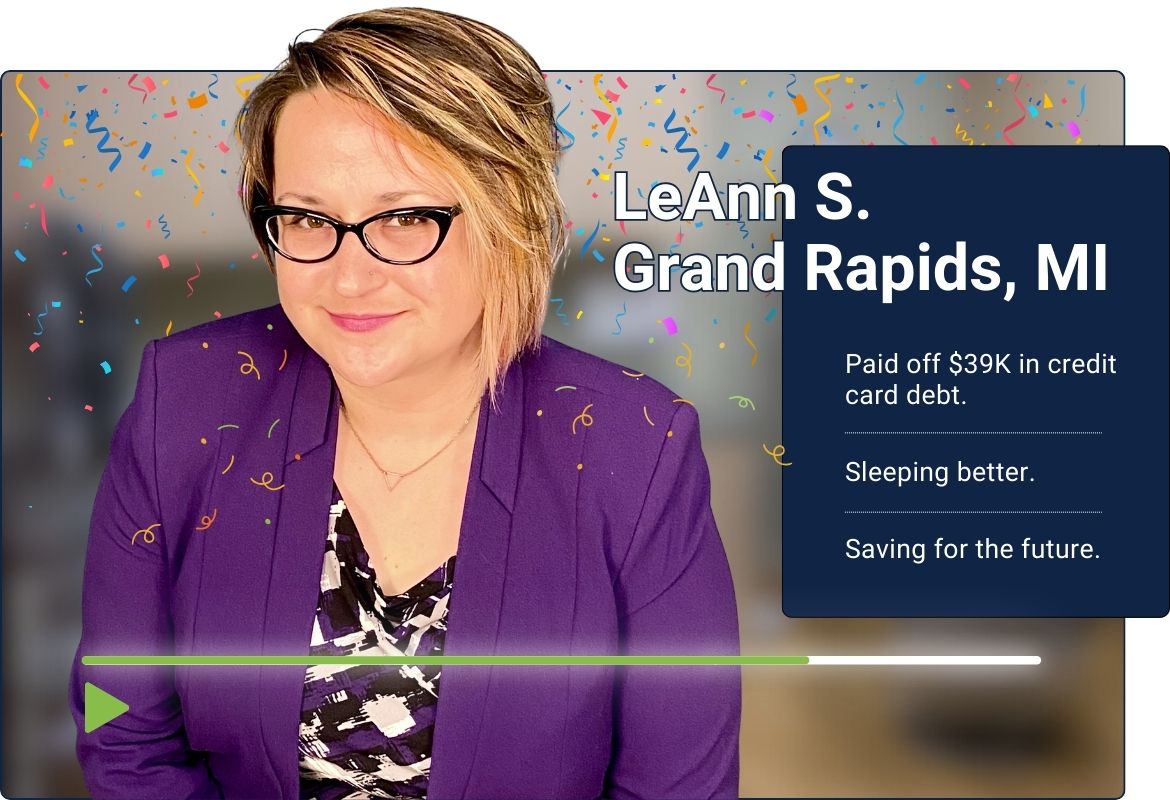

LeAnn's Testimonial

LIFE AFTER DEBT

You are not your debt. And you are not alone. Connect with GreenPath and learn how a Debt Management Program can put you back in control of your financial story.

“I reached out to my local credit union. They actually referred me to GreenPath.”

LeAnn takes professional pride in supporting others every day, but there came a time when she had to support herself. After connecting with GreenPath, she paid off $39k in credit card debt.

“I am sleeping better and not waking up in the middle of the night worrying about money related issues.”

The average American carries more than $6,000 in credit card debt, and the average interest rate is 21%–a record high. For LeAnn, this unforgiving economic landscape was not going to define her.

“The experience was so refreshing. I felt zero shame, zero guilt…my counselor was great.”

Check out Real $tories episode 45 to hear LeAnn’s story: how credit card debt became a frustrating cycle that she overcame, her experiences as a GreenPath client, and her advice to others on a similar journey.

GREENPATH IS A 60-YEAR TRUSTED NATIONAL NONPROFIT

We’ve been helping people build financial health and resiliency since 1961.

“GreenPath has helped me regain financial independence.”

- Client: LeAnn S.

- Grand Rapids, MI

- Healthcare Philanthropist

- Previously in Debt: $39,047

- DMP Status: Paid in Full

Save Money with A Debt Management Program

- Save on Interest: GreenPath partners with nearly 600 creditors across the country to arrange lower interest rates that save you money.

- Simplify Payment: You have enough to manage already so we’ve kept debt management simple with direct payment to GreenPath on your preferred schedule.

- Ditch Debt Faster: It’s time to break the cycle of carrying debt into the future. With a Debt Management Program, you can pay off your debt in 3 to 5 years while deepening your financial literacy.

What is A Debt Management Program

A Debt Management Program is designed to pay off your debt in 3-5 years, while helping you develop sound financial literacy.

- Save on Interest: GreenPath partners with nearly 600 creditors across the country to arrange lower interest rates that save you money.

- Simplify Payment: You have enough to manage already so we’ve kept debt management simple with direct payment to GreenPath on your preferred schedule.

- Ditch Debt Faster: It’s time to break the cycle of carrying debt into the future. With a Debt Management Program, you can pay off your debt in 3 to 5 years while deepening your financial literacy.

Counseling Hours

Contact GreenPath to conduct a free debt counseling session to see if our debt management program is right for you.

- Monday-Thursday 8:00 am – 10:00 pm Eastern

- Friday 8:00 am – 8:00 pm Eastern

- Saturday 9:00 am – 6:00 pm Eastern

Frequently Asked Questions

Debt Management Program set up fees and monthly fees vary based on your state of residence and debt amount. On average, GreenPath clients are charged a one-time enrollment fee of $35 and a $28 monthly fee. This is minimal considering the amount of money our clients typically save in waived late fees, waived over limit fees, and reduced credit card interest charges.

We work with most creditors throughout the U.S., including banks, credit unions, retailers, medical providers, auto finance and collection agencies.

Since the goal of a debt management program is to pay off debt, the credit cards enroll in the program will be closed. Most creditors will usually allow you to continue using one card for emergencies and travel.

GreenPath does not contact the credit bureaus when you enroll in a debt management program. However, because you will be closing lines of credit during the enrollment process, your score may dip. But over time, most people see their scores increase, because they are making payments in-full and on-time each month.

Yes, they are different. Debt management plans are designed to pay off the entire amount you owe in 3 to 5 years. If we can lower your interest rates, the total amount you pay to your credit card company is typically less than if you paid on your own. Debt settlement typically involves requesting credit card companies to forgive a portion of your debt in exchange for a lump sum payment.

Counseling Hours

Contact GreenPath to conduct a free debt counseling session to see if our debt management program is right for you.

- Monday-Thursday 8:00 am – 10:00 pm Eastern

- Friday 8:00 am – 8:00 pm Eastern

- Saturday 9:00 am – 6:00 pm Eastern

Take the First Step

Like thousands of other Debt Management Program clients, LeAnn learned that the first step is often the most important one. Take that first step and speak with financial counselor today.

Counseling Hours

Contact GreenPath to conduct a free debt counseling session to see if our debt management program is right for you.

- Monday-Thursday 8:00 am – 10:00 pm Eastern

- Friday 8:00 am – 8:00 pm Eastern

- Saturday 9:00 am – 6:00 pm Eastern

Find Your Fresh Start

GreenPath’s Debt Management Program helped LeAnn achieve her goals, and it can help you achieve yours.

Counseling Hours

Contact GreenPath to conduct a free debt counseling session to see if our debt management program is right for you.

- Monday-Thursday 8:00 am – 10:00 pm Eastern

- Friday 8:00 am – 8:00 pm Eastern

- Saturday 9:00 am – 6:00 pm Eastern

Real $tories Episode 45: LeAnn

Counseling Hours

Contact GreenPath to conduct a free debt counseling session to see if our debt management program is right for you.

- Monday-Thursday 8:00 am – 10:00 pm Eastern

- Friday 8:00 am – 8:00 pm Eastern

- Saturday 9:00 am – 6:00 pm Eastern