‘Tis the Season to be Debt Free

The holidays are a time for celebration, not stress. If high-interest debt is weighing you down, GreenPath is here to lend a hand this season. Our Debt Management Program is designed to help you pay down debt faster, so you spend more on joy, and less on interest.

Gift Yourself Peace of Mind

Lower Interest Payments

Our partnerships with nearly 600 financial organizations across the country allow us to arrange better rates, meaning you save money this season.

Paying Debt on Your Own

High interest rates, high minimum payments.

| Credit Cards | Interest Rates | Min. Payments |

| Card A | 29.40% | $150.00 |

| Card B | 27.49% | $240.00 |

| Card C | 27.15% | $210.00 |

| Total | $600.00 |

Paying Debt with GreenPath

Lower interest rates, lower minimum payments.

| Credit Cards | Interest Rates | Min. Payments |

| Card A | 9.90% | $120.00 |

| Card B | 8.0% | $175.00 |

| Card C | 9.90% | $130.00 |

| Total | $425.00 |

Actual interest rates will vary by client and creditor.

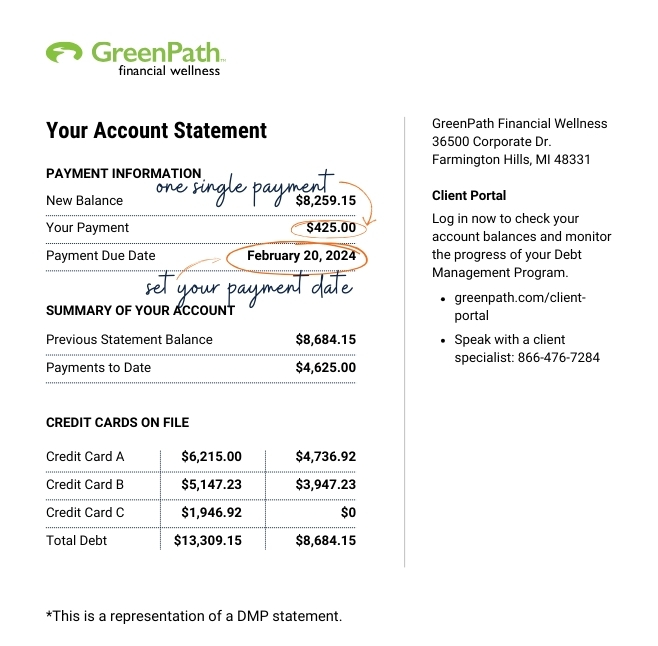

Simplified Money Management

Instead of juggling multiple bills every month, make one easy payment to GreenPath on your preferred schedule.

Simple Payment

One payment to pay off your debts. And choose a payment date that is convenient for you.

Faster Debt Payoff

The Debt Management Program is designed to help you pay off your debt within 3 to 5 years, leaving you with more financial room to plan for the future. Enter your debt below to calculate your savings.

How Your Debt is Calculated

- The pay “on your own” example assumes you make only the minimum payment.

- We use an interest rate of 24%, the GreenPath Debt Management Plan example shown is based on getting rid of your debt within 5 years.

- We use an average interest rate of 8%.

In most cases, we can work with your creditors to reduce your interest rate. Actual interest rates will vary by client and creditor.

NOTE: This is an example. It helps you see how a debt management plan might help you. IT IS NOT AN ACTUAL QUOTE.

Free Financial Education

As you pay off your debt, support your financial growth with free webinars, worksheets, and courses designed to meet you right where you are.

A Helping Hand When You Need It Most

GreenPath counselors are certified by the National Foundation for Credit Counseling (NFCC) and offer more than just a friendly voice. They take the time to listen, understand your situation, and create a personalized action plan that aligns with your financial goals. Because you deserve peace of mind…without the price tag.

Spread Joy and Save Money

Already dreading those January credit card statements? Prepare for Holiday Spending NowPrepare for Holiday Spending Now offers tips on maximizing your dollars. Call us today for your free counseling session this holiday season.