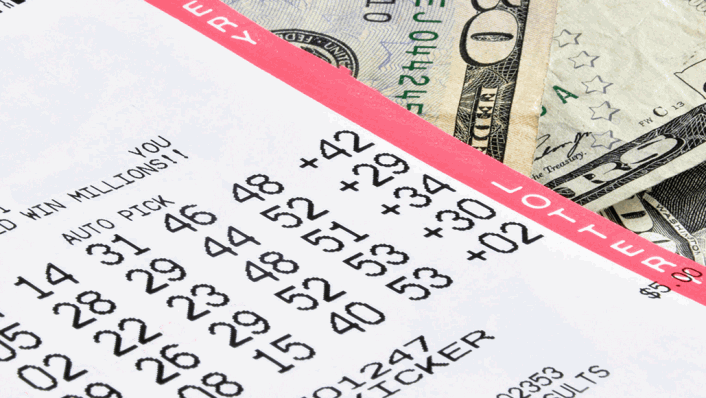

Is Playing the Lottery Worth the Gamble?

- September 27, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Savings

Partner with GreenPath to create a spending plan that puts you on the path to financial wellness We all have high hopes that one day our luck will change and we will win the lottery. While this dream is exciting to fantasize about, what are the odds that millionaire status is in your future? Odds of winning the lottery According...

3 Money Saving Back-to-School Shopping Tips

- August 19, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Budgeting, Family

The National Retail Federation (NRF) is expecting this year’s back-to-school shopping season to be the most expensive ever. According to their survey, on average, families with children in grades K-12, plan to spend nearly $700 and those with college students plan to spend nearly $1,000, both the highest ever recorded...

GreenPath CEO Kristen Holt: Tips for Avoiding Reverse Mortgage Foreclosure

- July 16, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Housing

Recent news coverage (“Detroit leads nation in reverse mortgage foreclosure rate”) has brought the escalating reverse mortgage foreclosure rate into the spotlight. A Free Press and USA Today analysis revealed that urban communities have been most impacted by the reverse mortgage foreclosure trend with Detroit leading...

How to Manage Your Credit Card Bills, Which Experts Say Are Late More Often – New York Times

- July 9, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: News

The New York Times recently interviewed GreenPath President & CEO Kristen Holt and GreenPath client Becky Willard for an article on how a growing number of people are having trouble paying their credit card bills. Read how a GreenPath Debt Management Plan helped Becky pay off $40,000 in about five years, saving her about $30,000 along the way.

Michigan veterans, families to get free financial counseling – WZZM13.com/ABC

- July 9, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: News

The Michigan Veterans Affairs Agency announced Monday that veterans and their families have access to free financial counseling through a state pilot program. GRAND RAPIDS, Mich. - The Michigan Veterans Affairs Agency announced July 1 that Michigan military veterans and their families now have access to free financial...

What Is a Credit Card Hardship Program?

- June 1, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: News

A Credit Card Hardship Program is a payment plan, negotiated via your issuer, that may temporarily lower interest and waive fees when a difficult circumstance hinders your ability to pay. Financial emergencies, setbacks and major life changes can come at you quickly, making it difficult to meet monthly financial obligations...

Looking To Get Out of Debt in 2019? Here’s How to Start

- January 4, 2019

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Budgeting, Financial Education

More than 30% of New Year’s resolutions are related to getting out of debt and saving money. Here are some tips on how you can make a successful resolution to get out of debt.

Identity Theft Insurance

- December 2, 2017

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Security

Identity theft can be a lengthy and costly process. If you are concerned about identity theft, you can purchase identity theft insurance.

Five Tips For 2017

- January 13, 2017

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Financial Health Tips

As we get back on schedule after the holidays, it's time to face 2017 head-on! Here are five tips for 2017 to help you on the path to financial wellness this year. Open a separate savings account to force yourself to build an emergency savings fund. Make it separate from your main financial institution, with no ATM...

Showing results 118-126 out of 133