The GreenPath Difference

Every year hundreds of partners and hundreds of thousands of people choose GreenPath because of the GreenPath Difference. We are a national nonprofit, focused on financial wellness. We are building a new financial culture and system to work for everyone. Our people-centered approach, ambitious goals, and creative strategies set us apart. We’re far more than a credit counseling agency.

Why We Do This Work

It’s actually really simple. We believe everyone deserves a chance to pursue their dreams, and we know that financial health is a key factor in getting there.

When people are financially well, they have more freedom to live the lives they want to live. They have more power to make choices about things like how they spend their time, where they work, where they live, or where their kids go to school.

Our Bold Goal

We have expanded our focus from credit counseling to financial wellness. In 2016, we set a bold goal to build a new financial culture and system to work for everyone. We call it “Remix the American Dream so that it works for everyone!” We are on a 10-year plan to accomplish this by 2027.

We will know we have succeeded when people feel prepared for life’s ups and downs, and have access to the tools and resources to manage their finances to support their goals. We will know we’ve made it when it’s no longer taboo to talk about debt or finances, and people are helping each other succeed by sharing their stories and tips around the dinner table, in the news, and in the classroom.

REMIX THE AMERICAN DREAM SO THAT IT WORKS FOR EVERYONE!

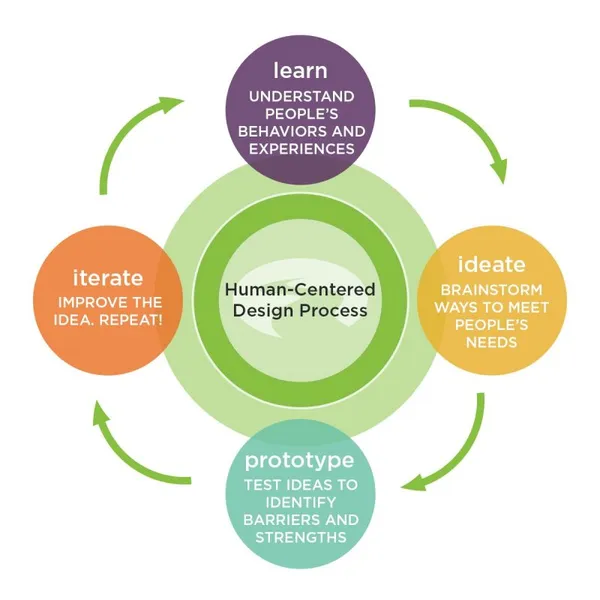

We Put People at the Center

Our guiding principle is to put people at the center of everything we do.

How can we help more people achieve their dreams? What do we all need to be able to buy that home we wish for, or pay for college, or take that dream vacation? How might we help our clients sleep better at night?

We’re asking our clients new questions too. We want to know what you’re concerned about. Each story reveals something new and unexpected. With empathy and insight, creative thinking and new ideas come alive, unleashing the power we all have to change our circumstances.

It Starts With Culture

We have been on a cultural journey to infuse human-centered design thinking into our DNA through training and practice. We hired a behavioral economist to help us understand why people make the financial choices they do. We invested in empathy coaching. Our team launched a “Client Love” project.

These creative methods and practices keep us connected to what people need. Anchoring our work in human behavior ensures that our ideas are effective in the real world, not just in theory.

We combine more than 60 years of experience in credit counseling, debt management and personal finance education with a people-centered creative culture. Through direct services, partnerships, innovation and influence, we are transforming the culture of financial wellness in our country.