Researching car models, financing options, and total costs upfront can help you avoid financial pitfalls.

Negotiating the best price and understanding loan terms, understanding auto loans and using an auto loan calculator can save you thousands over time.

Purchasing a car can have a big impact on your overall budget. GreenPath provides free financial counselingfree financial counseling if you need support in reviewing or modifying your budget.

Buying a car is one of the biggest financial choices you’ll make. While the overall inventory situation has improved, many are still experiencing sticker shock at the car lot when it’s time to shop.

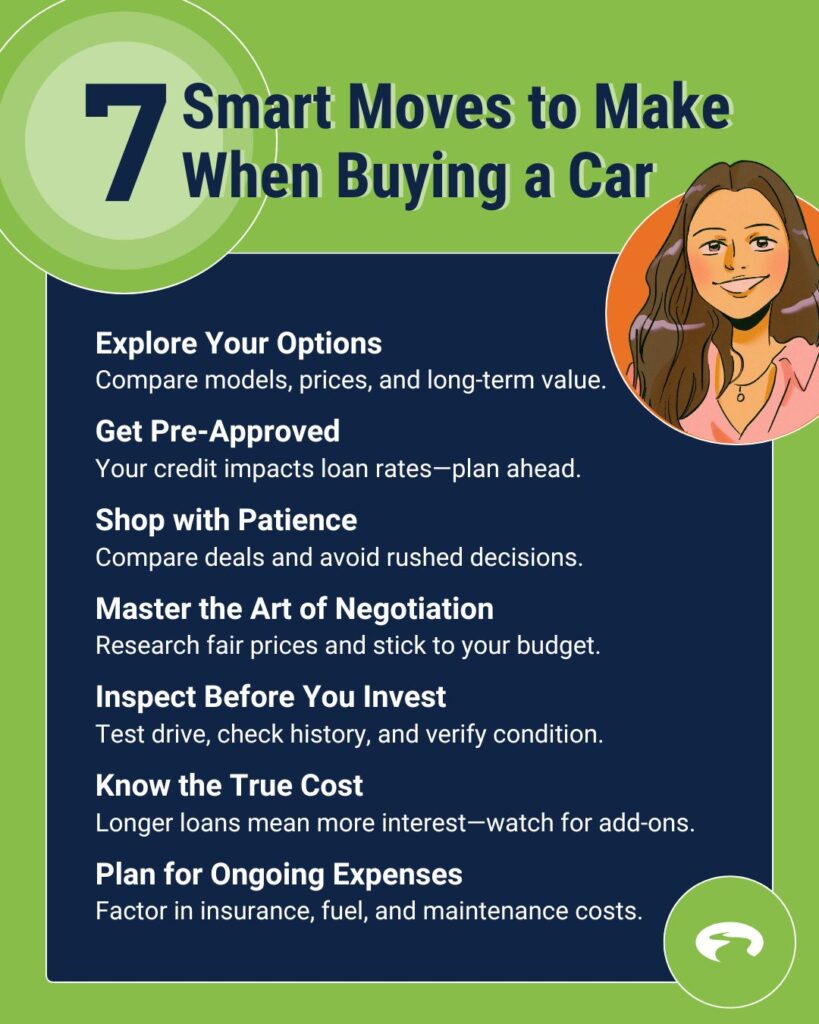

It’s easy to feel overwhelmed or pressured into a deal that may not be right for you but with the right preparation, you can take control of the process, avoid costly mistakes, and drive away with a car that fits your needs and budget. Follow these seven steps to make your car-buying journey smoother, smarter, and less stressful.

Step 1: Research Your Options

Before visiting a dealership, research car models, features, and price ranges that fit your budget. Compare fuel efficiency, safety ratings, and resale values to make an informed decision. This knowledge also strengthens your negotiating position when you’re ready to buy. Consider using a car buying service to compare in-stock vehicles and obtain upfront price offers from local certified dealers.

Step 2: Secure Auto Loan Financing

Decide whether buying or leasing suits your lifestyle and budget. Your credit score significantly impacts your auto loan’s interest rate—higher scores mean lower rates and monthly payments on your car loan. A strong credit history can help you secure better loan terms. Use an online loan payment calculator to estimate what you can afford before committing.

Buying vs. Car Leasing

- Buying: Best for long-term savings if you plan to drive the car for many years after paying off the loan.

- Leasing: Ideal for those who prefer a new car every few years and drive fewer than 15,000 miles per year. Understanding the lease agreement is crucial, as it outlines the terms and conditions of your leased vehicle.

New Cars vs. Used Cars

- New Cars: Customizable, come with warranties, but depreciate quickly. Car loans for new cars often come with competitive interest rates, making them an attractive option for financing your purchase.

- Used Cars: More affordable, depreciate slower, but may require more maintenance. Consider the growing market for electric vehicles, which can offer long-term savings on fuel and maintenance.

Step 3: Take Your Time

Shop around online and in-person to compare prices, inventory, and dealer incentives. Avoiding impulsive decisions—patience can lead to better deals. Tools like Kelley Blue Book can help you assess fair market value. Car dealers and leasing companies often have different incentives and offers, so it’s beneficial to compare their terms.

Step 4: Negotiate the Best Deal

Once you’ve chosen a car, be prepared to negotiate. A substantial down payment can improve your loan terms and reduce your monthly paymentsmonthly payments. Research fair prices ahead of time, and don’t be afraid to walk away if the deal doesn’t match your budget. Private sellers may offer lower prices, but purchases come without warranties or service support. Look out for special lease deals that may offer lower monthly payments for qualified buyers.

Step 5: Take Precautions

Always test drive the car and review its accident and maintenance history. If buying used, request a CARFAX report and consider a pre-purchase inspection by a trusted mechanic to avoid hidden repair costs.

If you plan to lease, be aware of the potential fees for breaking the lease early.

Step 6: Calculate Total Costs

Lower monthly payments aren’t always a good deal—longer loan terms often mean paying more in interest. Consider the structure of your monthly car payment and explore refinancing options to reduce interest rates and overall costs. Be cautious of extras like extended warranties that can drive up costs.

Step 7: Budget for Monthly Payments and Ongoing Expenses

Factor in added costs like insurance, fuel, maintenance, and registration fees. Car leasing can offer lower monthly payments but involves ongoing costs dictated by the leasing company. A car’s sticker price is just the beginning—ensure it fits comfortably within your overall budget.

Need to Review Your Budget?

A car is one of the biggest purchases you’ll make, and smart financial planning can save you thousands. GreenPath’s financial counselors can help you review your current budgetcurrent budget and discuss the best paths forward to make sure you’re on the right track. Talk to a certified financial expert at GreenPath for a free financial consultation.

GreenPath Financial Service

Free Debt Counseling

Take control of your finances, get tailored guidance and a hassle-free budgeting experience. GreenPath offers personalized advice on how to manage your money.