Financing a College Education

- June 14, 2017

- Category: College, Financial Education

Financing a college education is a huge and important decision, that will affect your student (and her future life, family and financial health) for the next 15 to 30 years of her life, or more.

Resume Writing Tips for Recent College Grads

- June 1, 2017

- Category: Financial Health Tips

As students around America graduate, hundreds of thousands of people will soon enter the full-time workforce for the first time. Many of you may be asking, “How do I land my first job when I don’t have any experience?” One key tool for job seekers is a resume. We have some resume writing tips for first-time job...

Signature Loans

Signature loans are unsecured personal loans. They are not backed by property. They can be used for many purposes. Amounts can vary.

Social Security

- May 31, 2017

- Category: Financial Education, Retirement

Social Security benefits are part of the retirement plan of almost every American worker. When pay Social Security taxes, you earn benefit “credits.”

Common Budgeting Mistakes

- May 30, 2017

- Category: Budgeting, Financial Education

Sticking to your budget is easier if you avoid these budgeting mistakes. Don’t use your credit to make ends meet. Make sure to keep track of your expenses.

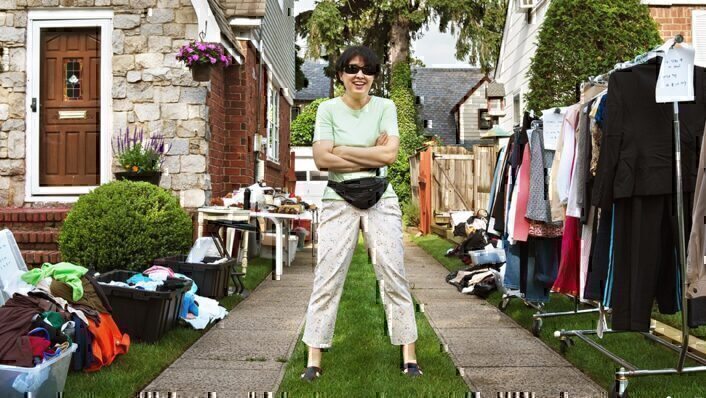

Liquidating Assets

You may want to sell some of your stuff to help pay down your debts. Liquidating assets means selling anything that can be sold or converted into cash.

Consequences of Filing for Bankruptcy: What Nobody Told You

The consequences of filing for bankruptcy can affect you into the future. Learn about what happens when you file for bankruptcy.

10 Ways to Rebuild Credit

Everyone faces setbacks from time to time. The good news is that you can rebuild your credit score. Please understand that there are no quick fixes for improving your scoreimproving your score. You may have seen ads for companies that promise, for a fee, to quickly repair your score. Credit repair does not work. Their usual...

Contacting Your Creditors

Are you struggling to pay your bills each month? If so, you may want to contact your creditors. They may have options for you.

Showing results 370-378 out of 446