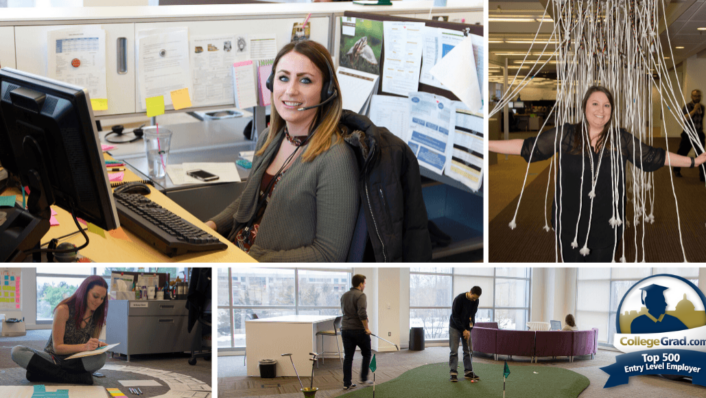

It’s a Three-Peat! GreenPath Named a Top Entry Level Employer by Collegegrad.com 3rd Year in a Row

- March 10, 2021

- Category: News

With ongoing hiring uncertainty due to the COVID crisis, one would think these are tough times for entry level college grads. While hiring growth has slowed, employers like GreenPath Financial Wellness are still hiring. And more importantly, entry level hiring has fundamentally changed. We’re proud that for the...

4 Steps Identity Theft Victims Should Take

- March 10, 2021

- Category: News

Consumer complaints about identity theft are rising from across the country. The leading complaint topic was identity theft, followed by debt collection complaints and impostor scams. This is a sure sign that people need to continue to pay attention and closely monitor their monthly credit card statements, credit reports...

How Entrepreneurs Can Tackle Challenges – Crain’s Detroit Business

- March 4, 2021

- Category: News

Donna Doleman Dickerson, Chief Marketing Officer, was recently interviewed by Mark S. Lee about the entrepreneur's challenges of managing personal and business finances and debt during these challenging times. It's been well documented that the number of small businesses that have shuttered over the last year due to the...

GreenPath And eGain Launch Anytime-Anywhere Virtual Financial Coach™

- March 2, 2021

- Category: News

The Virtual Financial Coach provides trusted, empathetic financial guidance and advice at scale through eGain’s award-winning Artificial Intelligence technology. Read Full Announcement FARMINGTON HILLS, MICH. and SUNNYVALE, CALIF. (March 2, 2021) – GreenPath Financial Wellness, a national nonprofit that provides...

Six GreenPath Financial Wellness Employees Recognized as Inspiring Leaders

- February 23, 2021

- Category: News

Famously, Martin Luther King, Jr. once asked: “Life’s most persistent and urgent question is, ‘What are you doing for others?” Transformational leaders are motivated by creating a positive change in the lives of others. GreenPath is proud that transformational leaders are part of our mission to empower financial...

Reasons to Pay Student Loans Amid the Pandemic – US News & World Report

- February 15, 2021

- Category: News

GreenPath shares with U.S. News and World Report Student Loan Ranger reasons to continue making monthly payments on your federal student loans if your budget allows. Read the Full Article > A lengthy reprieve from paying a student loan bill with no penalty? What could beat that? Last month, the Biden administration...

How Drug Convictions Affect Student Loans – U.S. News & World Report

- February 5, 2021

- Category: News

GreenPath shares with U.S. News and World Report Student Loan Ranger steps people can take to determine if they are eligible for federal student aid after a drug-related conviction. Read the Full Article > Are you ready to move forward with your education? Hoping to go back to college to prepare for a successful...

Prepaid cards can help your members stay on budget – CUInsight

- February 2, 2021

- Category: News

Excerpt from CUInsight shares how prepaid credit cards can help people create healthy budgeting habits. With the new year and tax season just beginning, your members are likely thinking of ways to develop their financial health so they can meet their goals. Our partner GreenPath Financial Wellness shares that the journey...

New Year, New Opportunities to Take Charge of Debt – Michigan Chronicle

- January 29, 2021

- Category: News

As part of GreenPath's Millennial Money Series, the Michigan Chronicle looks at the path to managing debt - and keeping track of changes in policies. Read the Full Article > With the early weeks of the Biden-Harris administration, how will your finances be impacted? President Biden recently outlined a $1.9 trillion...

Showing results 46-54 out of 248