News

-

GreenPath Financial Wellness Adds New Affiliate: Consumer Credit Counseling Service of Puerto Rico

GreenPath Financial Wellness expands debt management and housing services for residents in Puerto Rico…

-

Crain’s Detroit Notable Women in Nonprofits 2022 Honors Kristen Holt

GreenPath’s own Kristen Holt is among the honored this year. She infuses human-centered design…

-

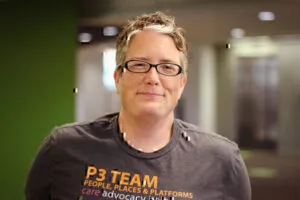

Julie Crichton Selected as Notable LGBTQ Leader in Business

Julie Crichton, GreenPath’s Director of Talent and Employee Experience, has been selected as a…

-

GreenPath Financial Wellness’ Empathy-Focused Financial Coaching Program Delivers Results

The pilot for GreenPath Financial Wellness’ Your Money Guide, an online, email, and telephone financial…