Couples build stronger relationships when they align on financial priorities instead of relying on high-pressure gift spending.

Shared financial goals — saving, planning, or investing together—can improve trust and long-term stability.

Simple, consistent money habits help reduce stress and improve communication between partners.

Valentine’s Day Spending Is Rising—So Is Financial Stress

Valentine’s Day 2026 is shaping up to break records, with consumers expected to shell out a record $29.1 billion and an average of nearly $200 per person on gifts this year. Yet at the same time, 46% of Americans say rising costs make the holiday harder to celebrate, and 26% feel pressure to spend, even when budgets are tight. And the holiday itself is changing: 35% of people plan to buy gifts for pets, and one-third will treat friends: proof that Valentine’s Day isn’t just a couples-only event anymore.

Against this backdrop of higher costs and changing expectations, some couples are looking for something more practical and meaningful than another short-lived gift. For many, that starts with an honest talk about money.

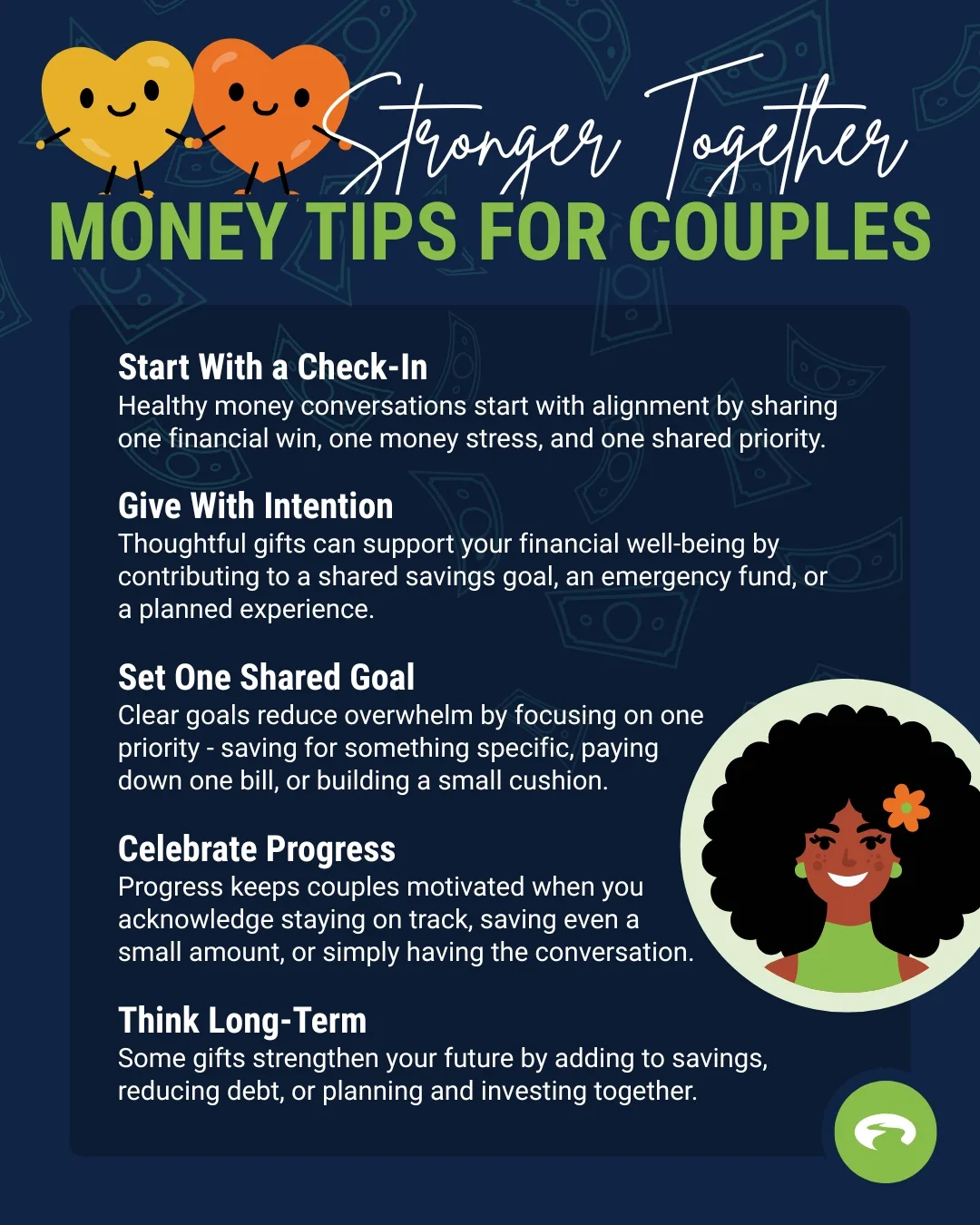

1. Start With a Financial Check-In, Not a Budget Talk

You don’t need a spreadsheet to begin talking about money. A short, low-pressure check-in can help partners understand where each other stands financially—without turning the conversation into a source of conflict.

Consider asking:

- What’s one financial habit you feel good about right now?

- What money-related stress is weighing on you?

- How do you feel about saving or planning together?

Studies consistently show that couples who communicate openly about finances report lower conflict and higher levels of trust. These conversations are less about numbers and more about alignment.

Try This

Set aside 10 minutes once a month for a recurring financial check-in.

2. Choose Gifts That Reduce Stress Later

When budgets are tight or financial stress is already present, even well-intended gifts can add anxiety instead of joy. That’s where financially thoughtful gifts can help. Gifts that support saving, planning, or shared experiences don’t replace traditional Valentine’s Day gifts—they complement them by strengthening security and reducing stress over time.

Practical ideas include:

- Starting a shared savings fund for something specific, like a weekend trip or home project

- Adding a small amount to a joint emergency fund

- Creating a shared list of no-cost or low-cost date ideas

A recent report found that most couples prefer simplicity over big price tags for special occasion gifts, with 61% spending under $100 on their partner—proof that meaningful doesn’t have to mean expensive.

Try This

Pick one shared financial priority to work on before spring.

3. Set One Clear, Shared Financial Goal

Joint goals don’t need to be intimidating. In fact, experts note that realistic, trackable goals are more sustainable and less overwhelming for couples trying to build momentum together—especially when life feels uncertain or budgets are tight.

Ideas for couples-friendly goals:

- Saving for a short trip, class, or experience

- Paying down one shared bill

- Building a small buffer for unexpected expenses

- Scheduling a twice-yearly “financial reset” weekend

Try This

Choose one goal with a deadline and track progress together.

4. Celebrate Progress to Keep Momentum

When money feels overwhelming, it’s easy for progress to go unnoticed. Many couples focus so much on what still needs to be done that they miss the fact they’re already moving in the right direction. Over time, that can make financial planning feel exhausting instead of motivating.

Recognizing small financial wins helps shift the focus from pressure to partnership. Acknowledging effort—not just outcomes—reinforces teamwork and makes it easier to stay engaged, especially when financial stress is already affecting the relationship.

Wins might include:

- Sticking to a spending plan for the week

- Completing a money check-in

- Adding even a small amount to savings

Celebrating accomplishments helps reduce the emotional load of finances and keeps motivation high, especially when financial stress is a known relationship strain point.

Try This

Decide in advance what counts as a “win” and how you’ll mark it—then keep the celebration small, repeatable, and budget-friendly (like a set takeout night or shared coffee walk).

5. Consider a Long-Term Financial Gift

The idea of a “financial gift” can feel intimidating or unromantic—especially if money has been a source of stress.source of stress. But long-term financial gifts aren’t about making dramatic changes or giving up meaningful gestures. They’re about taking small, supportive steps that make the future feel more secure for both partners. Choosing a gift that eases future pressure can be a quiet but powerful way to show care.

Long-horizon gift ideas include:

- Contributing to your partner’s savings account

- Starting or adding to a shared sinking fund for recurring expenses

- Beginning to invest together or scheduling regular financial planning time

- Making an extra payment toward shared debt

- Committing to one major financial task for the year, such as reviewing credit reports or consolidating debt

These actions build trust, stability, and flexibility—the foundations of long-term partnership.

Financial Support for Couples Building a Stronger Foundation

Financial stress is one of the most common challenges in relationships, but it doesn’t have to be something you navigate alone.

Talking openly about money, setting shared financial goals, and building sustainable habits over time can help reduce tension and strengthen trust. When couples feel aligned financially, they’re often better equipped to handle both everyday expenses and unexpected life changes.

GreenPath’s nonjudgmental financial counselors provide free financial counselingfree financial counseling for couples who want practical guidance without shame or pressure. Counselors work with couples to:

- Reduce financial stress and anxiety

- Clarify shared priorities and long-term goals

- Create realistic, sustainable financial plans that fit real life

Whether you’re just starting to talk about money together or working through ongoing financial challenges, the right support can make a meaningful difference. Strengthening your finances as a couple is one of the most practical and lasting ways to invest in your relationship—not just on Valentine’s Day, but throughout every stage of life.

GreenPath Financial Service

GreenPath, A Financial Resource

If you’re interested in building healthy financial habits, paying down debt, or saving for what matters most, take a look at these free financial tools.