Smart, budget-friendly meal planning can ease the stress of the holidays, reduce food waste, and help you keep spending manageable

You can make your grocery dollars go further by simplifying your menu, taking advantage of sales, and transforming leftovers into new meals.

If holiday budget feels overwhelming, GreenPath’s free financial counselingfree financial counseling can help you balance holiday spending with your long-term financial goals.

The holiday season is here again—and for many of us, that means joyful gatherings, favorite family recipes, and… the yearly challenge of keeping costs under controlkeeping costs under control with a budget-friendly Thanksgiving.

Between higher food prices, unpredictable sales, and shifting assistance programs, it can be tough to create a delicious, memorable meal for your Thanksgiving dinner while sticking to your budget.

And even if you don’t celebrate Thanksgiving, the same challenges apply to holiday dinners and seasonal get-togethers. Whether you’re hosting a Friendsgiving, a December potluck, or another festive meal, a few smart strategies can help you serve up great food without overspending.

Why Meal Planning Matters More This Year

Groceries have been creeping up in cost all year and recent changes in federal food assistance programs may temporarily affect SNAP (Supplemental Nutrition Assistance Program) distributions in some states. These shifts can create uncertainty for households that rely on benefits or are watching every dollar.

Regardless of whether you receive assistance, this is a good reminder that food budgets can be fragile. Prices rise, benefits change, and unexpected expenses happen. Planning your meals ahead can help reduce stress and keep your budget on trackkeep your budget on track. Flexible strategies, like scaling recipes, repurposing leftovers, or hosting potluck-style gatherings, can make holiday meals manageable and enjoyable for everyone, no matter your resources or family traditions.

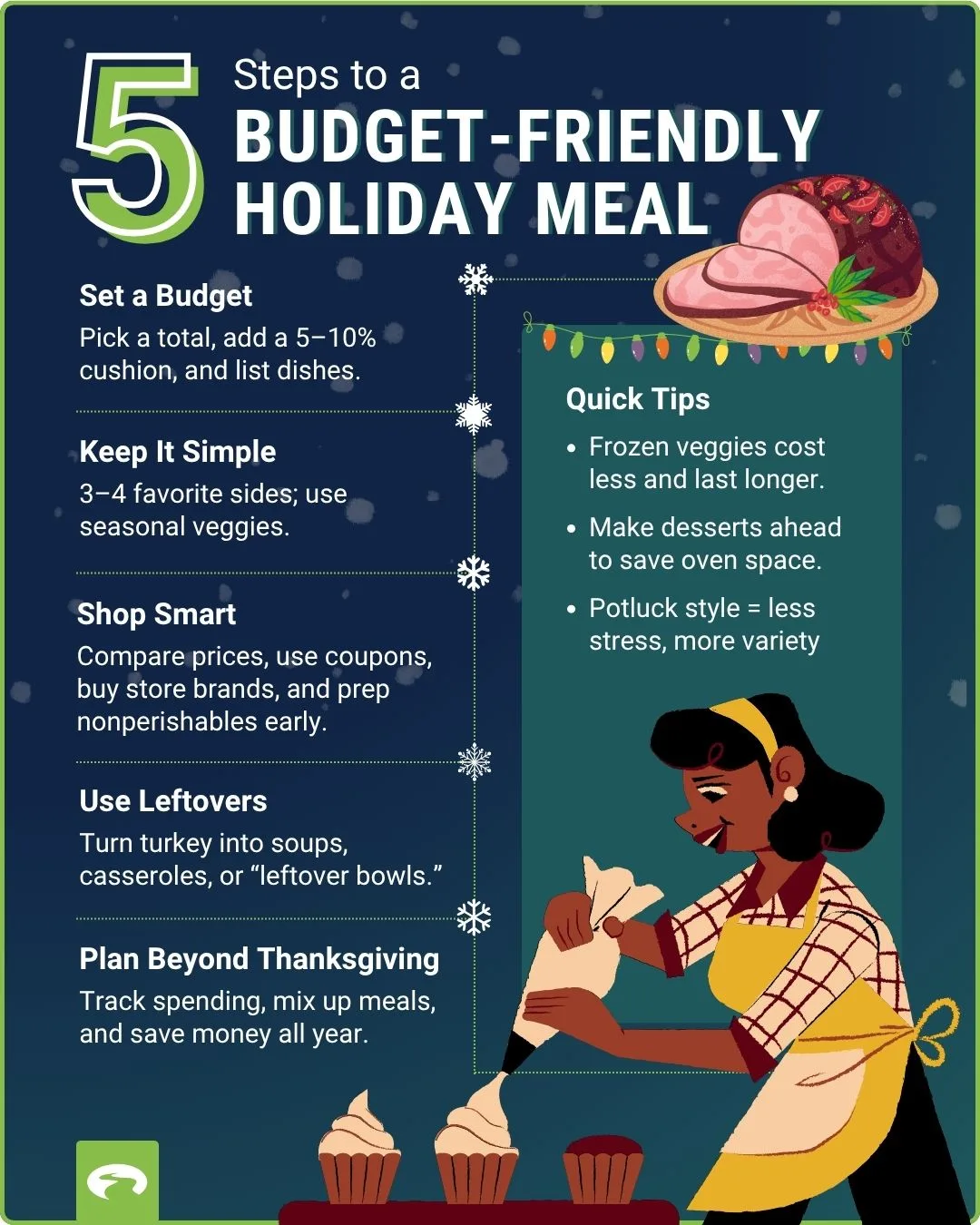

Step 1: Start with a Realistic (and Flexible) Food Budget

Think about your overall financial picture first. What can you reasonably spend on Thanksgiving this year without putting other billsother bills or goals at risk?

Once you know your number, make a list before you shop. List every dish you plan to make—main course, sides, drinks, desserts—and estimate costs for each. Estimate the number of servings for each dish to help with budgeting and ensure you have enough for everyone. That way, you can see where adjustments make sense before you hit the checkout line.

Money-Saving Tips

- Start with a set food budget—and build in wiggle room.

Pick a total amount you can afford for your holiday meal and aim to stay 5–10% under it. That extra cushion can help cover last-minute items (like ice, napkins, or extra butter) without throwing you off track. - Shop sales strategically.

Grocery stores often rotate holiday discounts on turkeys, potatoes, canned goods, and baking staples. Watch weekly ads and time your shopping for when your key ingredients hit their lowest price. - Buy in bulk when it makes sense.

If you’ll use items like flour, sugar, rice, or broth beyond Thanksgiving, stock up at warehouse clubs or discount grocers. Just skip bulk buys for perishables unless you can freeze or share them. - Lean into seasonal and plant-based sides.

Vegetables like squash, carrots, cabbage, and sweet potatoes are usually cheaper in November—and they shine in holiday dishes. Adding beans or lentils to casseroles or soups stretches protein without stretching your budget. - Rethink your bread game.

Instead of buying expensive artisan rolls or stuffing mix, repurpose day-old bakery bread—it’s often discounted and perfect for stuffing, breadcrumbs, or homemade croutons. - Waste nothing.

Save bones, veggie scraps, and herb stems to make broth or soup later in the week. Turn stale rolls into bread pudding or croutons. Little savings like these add up quickly. - Make it a team effort.

Hosting doesn’t have to mean footing the whole bill. Ask guests to bring their favorite dish or beverage—most people are happy to contribute, and it makes the meal more meaningful.

Step 2: Keep It Simple

You don’t need a dozen dishes to make Thanksgiving special. Keeping your Thanksgiving menu simple can save both time and money—and your guests will still leave happy and full.

Focus on 3–4 budget-friendly Thanksgiving sides everyone loves, like mashed potatoes, roasted veggies, or green bean casserole. Use seasonal ingredients—sweet potatoes, carrots, and squash are affordable and flavorful this time of year. A drizzle of olive oil, a sprinkle of herbs, or a touch of brown sugar goes a long way.

If turkey prices are high, roast a whole chicken or two—it’s easier on the wallet and still feels festive. For dessert, bake pumpkin pie or another easy make-ahead treat the night before to free up oven space.

Step 3: Shop Smart and Save Big

When it comes to holiday grocery shopping, timing is everything. Last-minute runs to the store often lead to overspending and forgotten ingredients. A little planning ahead can save you money—and a lot of stress.

Here’s how to shop smart for Thanksgiving:

- Plan early and compare prices.

Check store flyers, loyalty apps, and online deals a couple of weeks before the holiday. Many stores run Thanksgiving food sales on turkeys, canned goods, and baking staples—so stock up when prices drop. - Buy shelf-stable and frozen items first.

Pick up nonperishables like canned pumpkin, broth, and flour ahead of time. Frozen veggies, pie crusts, and even frozen turkeys often taste just as good as fresh and cost less. - Use coupons and store brands.

Clip digital coupons through grocery apps, and don’t overlook store-brand products—they can cut your total bill by 10% or more without sacrificing quality. - Think about oven space.

Plan which dishes can be made ahead or cooked in a slow cooker or air fryer. Prepping sides a day early can reduce both stress and energy costs on Thanksgiving Day. - Stick to your list.

Impulse buys are budget breakers. Shop with a list in hand—and eat before you go! Hungry shopping almost always leads to splurges you didn’t plan for.

Step 4: Get Creative with Leftovers

Many holiday favorites taste better the next day as flavors deepen. Cooking once and eating twice (or three times) doesn’t just stretch your food—it saves time, energy, and money. Plus, you’ll be less tempted to grab takeout during the hectic weeks before the next round of holidays.

- Transform turkey into something new.

Shred leftover turkey for hearty soups, cozy pot pies, or a big batch of chili you can freeze for later. You’ll stretch your protein—and your grocery dollars—without feeling like you’re eating the same thing twice. - Give mashed potatoes a second life.

Mix them with veggies, herbs, or cheese to make crispy mashed potato cakes. Or layer them into a simple shepherd’s pie using leftover turkey or ground meat. - Reimagine cranberry sauce.

Stir a spoonful into oatmeal, yogurt, or smoothies for a tangy boost. You can even warm it up and drizzle it over pancakes or baked apples for a sweet treat. - Build a leftover buffet.

Combine bits of different dishes for “Thanksgiving bowls” or wraps—turkey, veggies, gravy, and stuffing all layered together. It’s quick, satisfying, and helps prevent food waste.

Step 5: Plan Beyond Thanksgiving

Meal planning isn’t just for the holidays—it’s a powerful habit that can help you stay on track all year. After the holiday, take a few minutes to reflect:

- Did you overspend? If so, what part of the plan needs adjusting?

- Did you buy more than you needed?

- Were there ingredients that went unused?

- Did you consider serving sizes to avoid waste?

Experimenting with new recipes can help keep meals flavorful and interesting. Try mixing up your meal routine to stay motivated and save money.

Small changes—like choosing two meatless meals per week or shopping with a calculator in hand—can free up serious cash over time.

GreenPath Can Help

Thanksgiving (and every holiday) is about gratitude, not perfection. Whether your table is surrounded by family or shared with a few close friends, what truly matters is connection—not how much you spend.

If rising grocery prices, credit card debt, or post-holiday expenses have you worried, GreenPath’s NFCC-certified financial counselors can help you create a personalized plan to get back on track. From budgeting and money management to exploring debt repaymentexploring debt repayment options, you’ll get guidance that fits your goals and your life.

You Might Also Be Interested In…

Webinar: Spread Joy & Save Money: Make it a Happy and Financially Healthy Holiday SeasonSpread Joy & Save Money: Make it a Happy and Financially Healthy Holiday Season

What You Will Learn

- How to prepare a holiday budget without stressing your wallet

- How to reduce spending on gifts and other holiday specific expenses

- Ideas to create lasting memories at little to no cost

GreenPath Financial Service

Debt Management Program

GreenPath is a 60-year trusted national nonprofit, learn how GreenPath’s Debt Management Program can help you pay off your debt in 3-5 years, while helping you develop sound financial literacy.