Prioritize essentials with care. Start by catching up on housing, utilities, and other must-pay bills. If you’re feeling overwhelmed, reach out early to landlords or lenders—they can often work with you.

Use backpay wisely, not just quickly. Treat it as a chance to ease stress: rebuild savings, pay down high-interest debt, and create breathing room for your family’s financial stability.

You don’t have to navigate this alone. GreenPath’s certified financial counselors can help you craft a personalized plan, offering guidance and reassurance as you recover and prepare for the months ahead.

Even as government operations resume, many households are still feeling the strain —from missed paychecks to rising costs of everyday essentials. Financial stress doesn’t disappear overnight, and it’s normal to feel uncertain about how to move forward.

Whether your income was directly affected by the shutdownaffected by the shutdown, you’re a contractor who may not receive backpay, or you’re simply trying to get back on solid ground, now is a good time to regroup, rebuild, and create a plan for financial recovery for the months ahead.

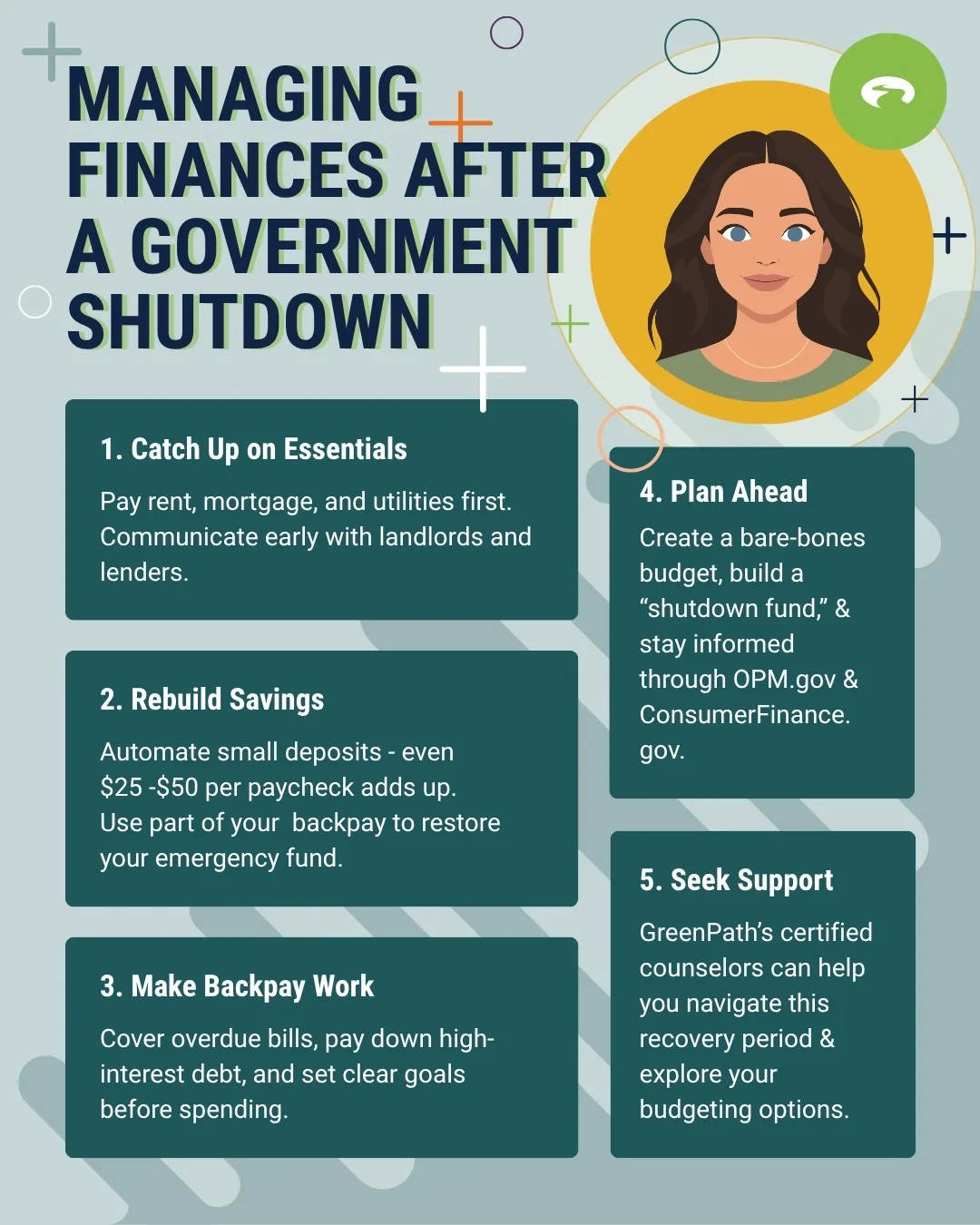

1. Catch Up on Urgent Expenses First

When backpay finally arrives, the relief can be overwhelming. After weeks (or months) of uncertainty, it’s natural to want to breathe, celebrate, or enjoy a long-delayed comfort. Before doing that, take a moment to prioritize the essentialsprioritize the essentials and rebuild stability step by step.

- Start with housing and utilities. Keeping a roof over your head and the lights on comes first. Bring accounts current to avoid late fees or service interruptions.

- Double-check due dates. Some landlords, lenders, or service providers may have paused collections or offered grace periods during the shutdown. Review your statements and verify what’s owed before sending payments.

- Stay in touch with creditors. If you’re still catching up, reach out early to explain your situation and ask about repayment plans or hardship options. Most companies would rather work with you than send accounts to collections.

- Explore local or federal assistance programs. If you’re struggling to cover essentials, programs such as utility relief funds, food assistance, or emergency housing assistance may be available.

Tip

Keep written records of all communications, agreements, or extensions. Documentation helps protect you if billing disputes or credit issues arise later.

2. Rebuild Your Financial Cushion

If you had to dip into your emergency savings—or rely on credit cards to get by—you’re not alone. Rebuilding your safety net may feel daunting, but consistency matters. Every small step adds stability and confidence for the future.

- Automate your savings. Set up a recurring transfer to savings right after each paycheck hits your account. Treat it like any other bill you “owe yourself.”

- Start where you can. Even $25–$50 per pay period adds up over time and helps re-establish the habit of saving.

- Use extra funds intentionally. If you receive backpay, a tax refund, or other windfalls, set aside a portion for savings before adjusting lifestyle spending.

Having even one month’s worth of expenses in reserve can turn a future disruption from a crisis into a manageable inconvenience. Think of this as rebuilding peace of mind—one deposit at a time.

3. Make Backpay Work Harder for You

Backpay represents more than overdue earnings—it’s a chance to get back on track and plan ahead. Without a plan, though, it can disappear faster than expected. To make your money count:

- Cover essentials first. Bring rent, utilities, and transportation payments current, so daily life feels steady again.

- Tackle high-interest debt. Paying down credit cardsPaying down credit cards or payday loans reduces financial stress and helps free up future cash flow.

- Rebuild your savings. Even a small “shutdown buffer” can provide breathing room if disruptions happen again.

- Plan for the future. Assign every dollar a purpose—whether that’s catching up on bills, saving for retirement, or supporting family needs.

- Allow yourself a small reward. It’s okay to acknowledge how difficult this period has been. Budget something modest that brings you joy—guilt-free.

Tools like Mint, YNAB, or GreenPath’s budgeting worksheetbudgeting worksheet can help track progress and keep spending on target.

4. Prepare for Possible Future Disruptions

Shutdowns and income gaps can feel unpredictable—but having a plan makes them far less frightening. A little preparation now can go a long way toward protecting your peace of mind next time.

- Create a “bare-bones” budget. Identify essential expenses—like rent, utilities, food, and medication—so you know exactly what to maintain if your income is interrupted.

- Build a “shutdown fund.” Aim to set aside one paycheck’s worth of expenses over time. Even partial progress offers a powerful sense of control.

- Know your resources. Research benefits like unemployment assistance, hardship loans, or union support funds that may become available during future shutdowns.

- Use credit strategically. Keep lines of credit open for true emergencies but avoid taking on new high-interest debt that can add stress later.

- Stay informed. Follow updates from OPM.gov and ConsumerFinance.gov to track policy and benefit changes.

You’ve weathered a challenging time. Taking these steps now isn’t just about recovery—it’s about building lasting financial wellness and resilience for whatever comes next.

5. Focus on Long-Term Financial Wellness

Once immediate pressures ease, it’s the perfect time to focus on strengthening your long-term financial health. Think of this as rebuilding not just your budget—but your confidence.

- Revisit your budget. Adjust for any ongoing changes to income or expenses and look for opportunities to simplify or reduce recurring costs.

- Check your credit report. Review it for errors, especially if missed or delayed payments during the shutdown were reported incorrectly. You can get free reports from AnnualCreditReport.com.

- Seek expert support. A certified financial counselor—like those at GreenPath—can help you create a realistic plan to pay down debt, rebuild savings, and move forward with clarity.

Free Financial Counseling and Support from GreenPath

Recovering from a government shutdown—or any financial disruption—takes time, patience, and planning. GreenPath offers free, confidential counseling with NFCC-certified financial counselors who can:

- Assess your current finances and help you understand the impact of missed paychecks or unexpected expenses.

- Create a personalized recovery plan for catching up on bills, paying down debt, and rebuilding savings.

- Provide tools and guidance for budgeting and long-term financial wellness.

Even small steps, guided by expert support, can make a big difference in regaining stability and peace of mind. GreenPath counselors help you turn uncertainty into actionable steps.

Getting started is simple—schedule a free session, discuss your situation with a professional, and walk away with a clear, manageable plan to move forward with confidence.

GreenPath Financial Service

Debt Management Program

GreenPath is a 60-year trusted national nonprofit, learn how GreenPath’s Debt Management Program can help you pay off your debt in 3-5 years, while helping you develop sound financial literacy.