A government shutdown can cause sudden income loss, but there are steps you can take to reduce stress and stay afloat.

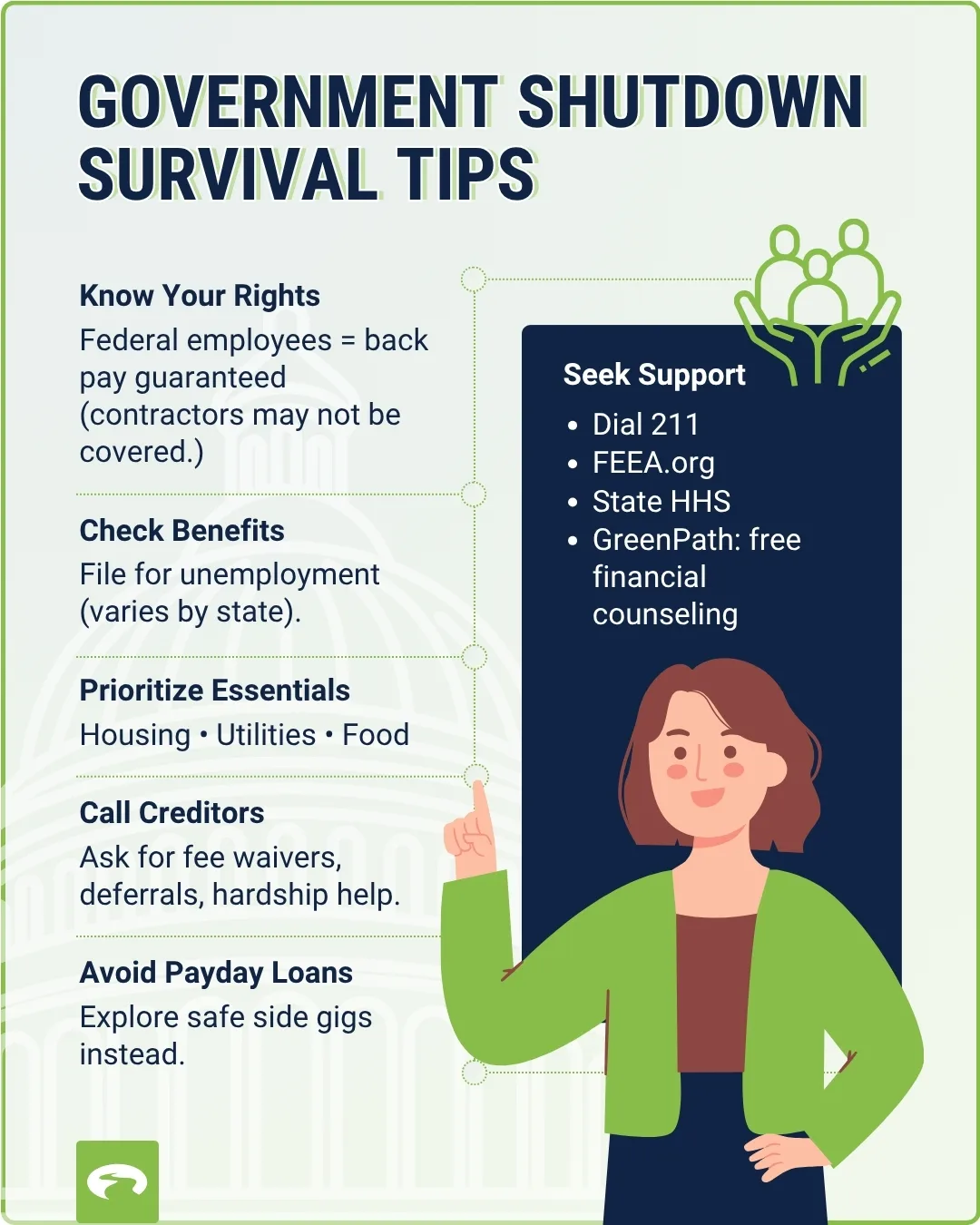

Federal employees are guaranteed back pay once the shutdown ends, but contractors and essential workers may not receive the same protections.

Free financial counselingFree financial counseling and community resources are available to help you navigate financial challenges during a shutdown.

When a government shutdown happens, it’s more than a political event—it directly affects households and communities. If you’re a federal worker, contractor, or someone indirectly impacted, the sudden loss of income can feel overwhelming.

You are not alone. And you are not without options. Here are some immediate steps you can take to stabilize your finances and access support.

Stay Informed and Connected

First things first—stay updated on the shutdown’s progress. Having information helps you plan and adjust. Government agencies and news outlets like the Associated Press, Reuters, or your local public radio station provide real-time updates and alerts.

Don’t go through this alone. Lean on friends, family, coworkers, and community groups. Talking about what you’re experiencing can ease stress and may connect you to resources you hadn’t considered.

Take Care of Yourself and Your Family

Shutdowns are stressful. Make space for your physical and mental health—eat well, exercise, and step away from the news when it gets overwhelming. Your well-being is just as important as your budget.

Smart Financial Moves During a Government Shutdown

Losing a paycheck, even temporarily, can throw household finances into chaos. Here are some steps that can help:

- Know your back pay rights. All furloughed federal employees are guaranteed retroactive pay once the shutdown ends, under the Government Employee Fair Treatment Act of 2019. Contractors, however, are generally not covered by that law and may not be entitled to back pay.

- Check unemployment eligibility. Furloughed federal employees may qualify for Unemployment Compensation for Federal Employees (UCFE), but rules vary by state (OPM.gov). Essential (excepted) employees required to work without pay are generally ineligible. Contractors typically do not qualify under UCFE

- Talk to creditors before you miss a payment. Many banks, mortgage lenders, and service providers offer hardship programs (fee waivers, temporary forbearance, deferrals), but these aren’t guaranteed—ask what’s available.

- Prioritize housing, utilities, and essentials. Pay for food, rent/mortgage, and essential expensesessential expenses before unsecured debts like credit cards. Keeping a roof over your head and lights on comes first.

- Look into community resources. Call 211 or visit 211.org to connect with food banks, housing support, or health services.

- Use caution with payday loans or “quick cash” options. These often come with high interest and fees, which can worsen your financial situation long term. Instead, check with your financial institution to see what options they may offer.

- Consider short-term income options. Depending on your situation, side jobs such as rideshare driving or tutoring may help temporarily, though they may not be feasible for everyone.

- Talk to creditors before you miss a payment. Many banks, mortgage lenders, and service providers offer hardship programs (fee waivers, temporary forbearance, deferrals), but these aren’t guaranteed—ask what’s available.

You Don’t Have to Do This Alone.

- GreenPath Financial Wellness: Connect with NFCC- and HUD- certified financial counselors who can help you navigate your options and build a plan.

- 211: Dial 211 or visit 211.org for food, housing, and utility support.

- Federal Employee Education & Assistance Fund (FEEA): Offers limited emergency hardship loans and grants for eligible federal employees (FEEA.org).

- State Health & Human Services: Visit your state’s HHS website for programs related to food, healthcare, and emergency assistance.

GreenPath Financial Service

Debt Management Program

GreenPath is a 60-year trusted national nonprofit, learn how GreenPath’s Debt Management Program can help you pay off your debt in 3-5 years, while helping you develop sound financial literacy.