A Smarter Way to Ditch Debt

You’ve been paying and paying…but your balance barely budges. High-interest credit cards are designed to keep you in debt. A smarter plan can help you lower your interest, cut monthly payments, and pay off debt years faster—no gimmicks, no new loan, just a proven, people-first solution that puts you in control.

Why Pay More Than You Have To?

Ignoring your debt won’t make it disappear—it will only make it harder to tackle down the road.

Without a plan, here’s what you might be facing:

Credit card balances that feel stuck, no matter how much you pay each month

Late fees and missed payments that add unnecessary pressure

Calls from creditors that add more stress to your day

Ongoing anxiety about how to stay on top of everything

No room in your budget for unexpected expenses or savings

A future filled with financial uncertainty, instead of the peace of mind you deserve

Hi. We’re GreenPath.

Founded in 1961, GreenPath Financial Wellness is a trusted, national nonprofit that’s helped millions of people find financial peace of mind. It’s time to break free from high-interest credit card debt through our proven Debt Management Program (DMP), and now we’ve put the power in your hands—online, on your time.

A Plan That Works. Finally.

You’ve tried managing it alone—but you don’t have to any longer. GreenPath’s Debt Management Program (DMP) is a structured repayment plan that helps you take control of your finances, save money, and pay off your debt faster. Here’s how we do it:

Lower Your Interest Rates

Our clients start with interest rates as high as 28%. By working directly with your creditors, we can often lower that. The average DMP client has an interest rate of 6.6%.

Reduce Your Monthly Payments

Clients save an average of $199/month—money that can go toward your savings, emergency fund, retirement or education.

Pay Off Debt Sooner

Why drag out the high interest timeline? On average, our DMP clients eliminate debt seven years sooner.

Save Over $29,700 in Interest

On average, our clients save $29,700in total interest charges—what could you do with that extra savings?

Paying on a DMP vs. Your Own

| Off DMP | On DMP | |

|---|---|---|

| Average starting debt balance | $17,667 | $17,667 |

| Average number of credit cards enrolled | 4 | 4 |

| Average interest rate | 28% | 6.6% |

| Monthly payment | $589(1) | $390(2) |

| Time to pay off debt | 135 months | 50 months |

| Total interest paid | $31,975 | $2,258 |

| DMP fees | $0 | $1,550 (3) |

| Total cost | $49,642 | $21,475 |

(1) Monthly payment Off DMP is calculated as 1% of the principal plus interest (2) Monthly payment On DMP includes average monthly fee of $31. Fees are determined based on applicable state law and may also include an enrollment fee. (3) DMP Fee total is the average $31/mo fee for the average time to pay off debts of 50 month.

Get Started in 3 Steps

In just a few minutes, you’ll find out if a Debt Management Program can help you lower your interest, reduce your monthly payments, and pay off debt faster. Here’s how it works:

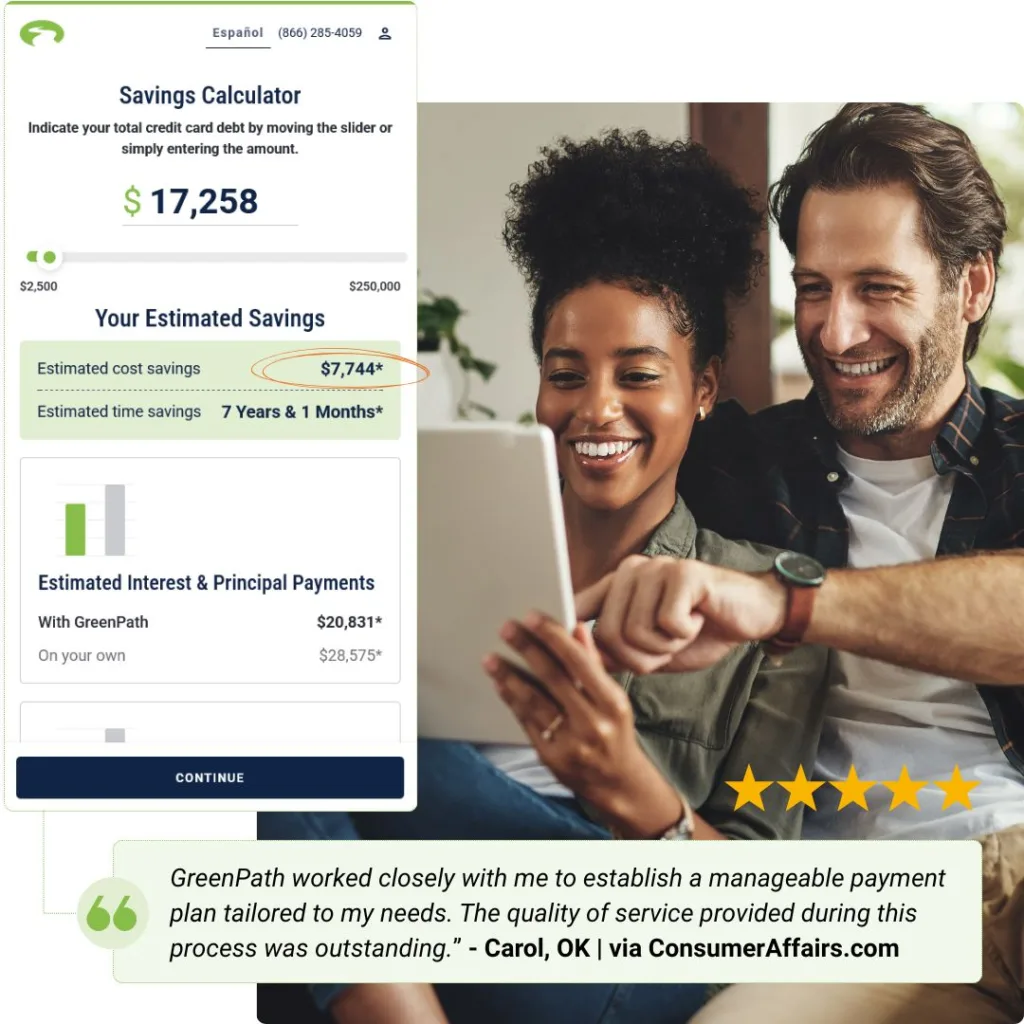

See Potential Savings

Use our savings calculator for an estimate of how much time and money you could save on a Debt Management Program.

Personalize Your Results

Share some basic information so we can personalize your results.

Get a Recommendation

See out where you stand and whether a Debt Management Program is a good fit.

60+ Years of Experience. Billions in Debt Resolved.

For more than 60 years, GreenPath has been a leader in financial wellness. When you work with GreenPath, you’re getting expert guidance, proven results, and a team that’s recognized across the country for doing things the right way.

- NFCC-Accredited: Trusted by over 200,000 people every year

- A+ Rated with the BBB: Respected, reliable, and effective

- 550+ partnerships with financial institutions nationwide, working together to support positive financial outcomes

- NFCC- and HUD-certified experts, ensuring knowledgeable and compassionate guidance

- 85.8% of survey respondents said working with GreenPath reduced their financial stress

- 86.6% said they felt more confident in reaching their financial goals after counseling

We’ve Helped Millions Find Their Fresh Start. It’s Your Turn.

You don’t have to keep treading water. The stress, the high-interest payments, the feeling that you’ll never catch up—it ends here.

With GreenPath, you get more than just a plan. You get a team that’s in your corner, fighting to help you lower your rates, simplify your payments, and ditch debt years faster. This is real, lasting relief—backed by decades of experience and proven results. So many of our clients say I wish I had done this sooner. And soon you might too.

Privacy Statement | Terms of Use | Sitemap | Licensing Disclosure | Accessibility

© 2025 GreenPath, Inc. All Rights Reserved. 36500 Corporate Dr. Farmington Hills, MI 48331 | We Do Not Lend Money