You’re not alone – resuming student loan payments can feel scary, but there are flexible income-driven options and resources to guide you.

Know the deadlines and consequences: missed payments can lead to wage garnishments, tax refund offsets, or Social Security impacts.

If student loans and high-interest debt have you overwhelmed, connect with GreenPath for guidance and budgeting supportguidance and budgeting support.

What’s Changing—and Why It Matters

Let’s start with the facts. As of August 1, 2025, interest began accruing again on loans under the SAVE (Saving on a Valuable Education) plan, and collections resumed for defaulted borrowers in May 2025. That means if you were in forbearance or income-driven forgiveness programs, you’re likely now facing mounting interest, payments, and potential consequences.

For many, these changes could mean roughly $3,500 more in interest annually, and monthly payments may jump by around $300 on average. Missed payments now carry real financial risks – like wage garnishment, withheld tax refunds, or even Social Security offsets.

What You Can Do – Practical Steps That Help

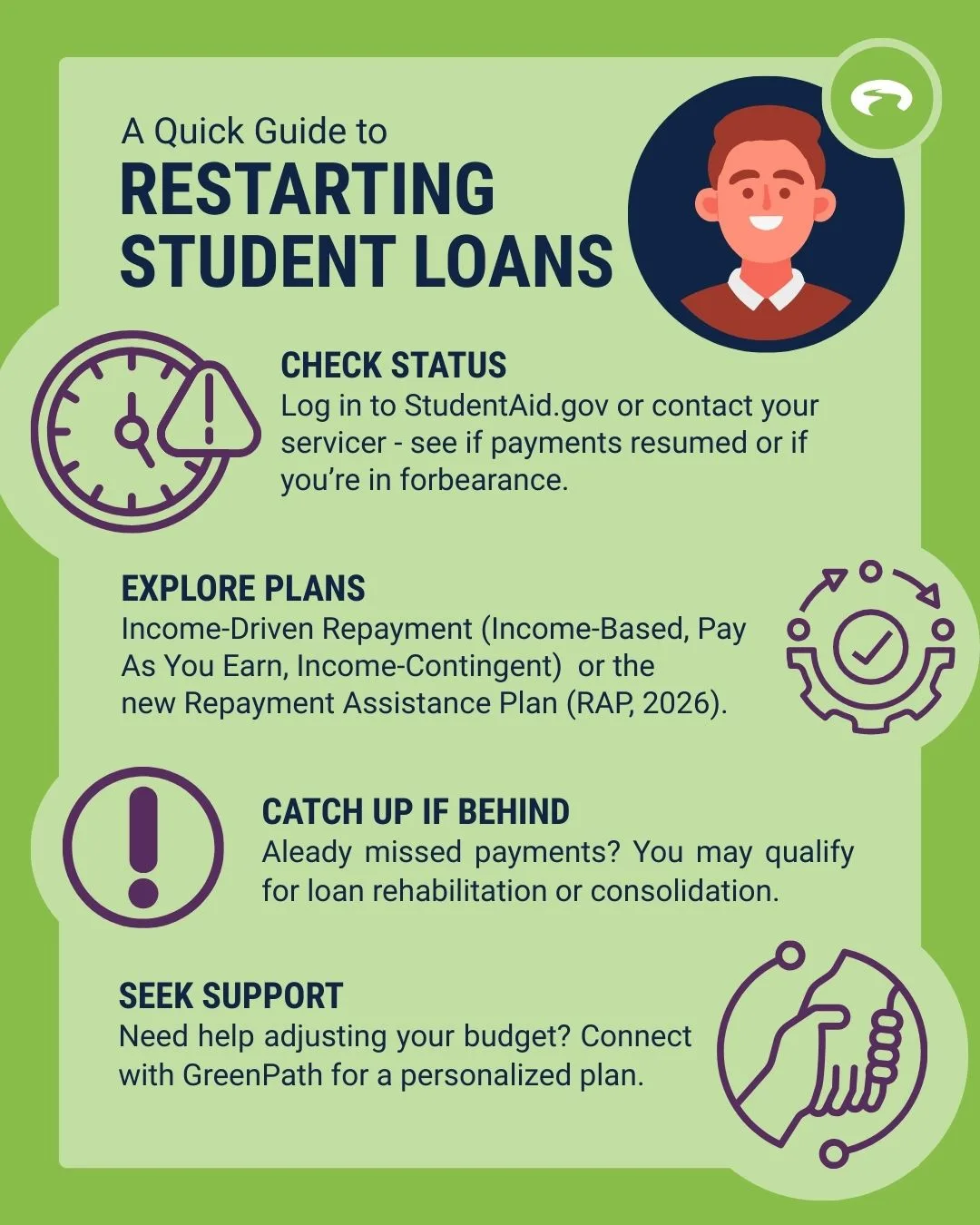

- Review your repayment status now. Log in to StudentAid.gov or contact your servicer to see whether your loans resumed payments or if you’re still in some form of administrative forbearance.

- Explore income-driven repayment (IDR) plans. Options like IBR, PAYE, ICR, or possibly the newer RAP (Repayment Assistance Plan in 2026) may offer more affordable monthly payments based on your income and family. The new RAP under the “One Big Beautiful Bill” might include features such as capped interest, waived interest if your payment doesn’t cover it, and even a government contribution to ensure your balance starts decreasing.

APPLY FOR IDR PLANS HERE. - Use an official estimator or your servicer’s tools to compare plans—especially to protect against rising balances and avoid defaults.

- Act quickly if you’re behind. The Department of Education began collections in May 2025, including aggressive actions like garnishments and offsets. If you’ve missed payments, you still may qualify for loan rehabilitation or consolidation to stop default consequences.

- Rehabilitation = fixes a defaulted loan by making agreed payments.

- Consolidation = combines multiple loans into one, possibly fixing defaults too, and can make payments simpler.

- Be alert to deadlines. Though collections and interest resumed, first payments under newly structured plans may not be due until December 2025, so get ahead now—don’t wait until the last minute.

Navigate with Confidence (Even When It Feels Overwhelming)

Policies have been shifting fast—courts blocking SAVE, interest starting despite forbearance, new plans on the horizon, and processing backlogs. It’s confusing, to say the least. But you don’t have to go through this alone.

- Talk to your loan servicer – ask what options are available.

- Staying informed. Visit StudentAid.gov for updates on policies, deadlines, and application information.

- Seek Budgeting Support: Get judgment-free help from an NFCC-certified GreenPath counselor. We’ll help you:

- Review your student loan types and statuses

- Explore your repayment and relief options

- Build a custom financial wellness plan

This period might feel like a financial minefield—with uncertainty at every turn—but remember: you’re not navigating it alone. Many of us are in the same boat. By taking small, consistent steps, you can regain control and make sure your payments work for your life—not the other way around.

You Might Also Be Interested In…

GreenPath Financial Service

Resources for Students and Graduates

If you’re starting college or is now repaying your student loans, take a look at these resources from GreenPath. These resources can help you plan for a financially healthy future.