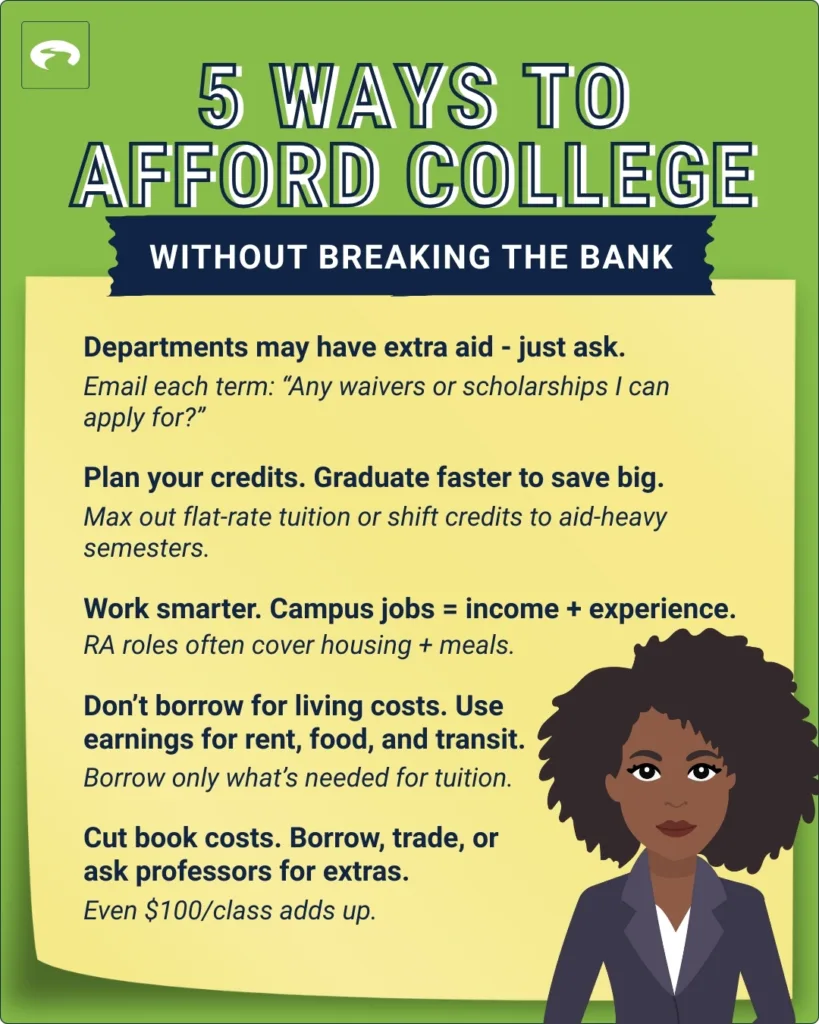

There’s often hidden financial aid available—just ask your department regularly and directly.

Strategic class planning and smart job choices can cut costs and help you graduate faster.

Minimizing living expenses and textbook costs can significantly reduce your need for student loans.

College is one of the biggest decisions you’ll ever make—and figuring out how to pay for it can feel overwhelming. The good news? You don’t need to go into massive debt to earn a degree.

As someone who completed a doctorate without taking on any new debt—and now teaches public health and financial wellnessfinancial wellness—I want to help you do the same. Whether you’re a student making this decision on your own or part of a family navigating college for the first time, these five tips will help you make smart financial choices and stay on track for graduation without breaking the bank.

1. Ask Your Department About Hidden Money

Many students fill out the FAFSA and think that’s it for financial aid. But there’s often more money available—if you know where to look.

Colleges sometimes have extra tuition funds, scholarships, or paid assistantships that aren’t widely advertised. These may become available when another student drops out or if a professor receives new grant funding.

Each semester during graduate school, I emailed my department coordinator to ask if any funding was available. That habit helped me receive over $17,000 in additional support.

Try sending this message:

Hi [Coordinator], I’m registered for classes this semester and looking for additional financial help. Are there any scholarships, tuition waivers, or assistantships available in the department? I’d love to be considered. Thank you for your time and support.

Asking early and often is one of the most powerful tools you have.

2. Plan Your Credits to Save Time and Money

The longer you stay in school, the more you pay—so plan to finish as efficiently as possible.

Some schools charge a flat tuition rate for full-time students. That means taking 18 credits may cost the same as taking 12. If this applies to you, loading up your schedule (with balance!) could help you graduate earlier and save thousands.

Other schools charge per credit hour. In that case, consider taking fewer classes during semesters when you don’t have aid, and more when you do.

Ask your advisor:

Can we map out my class plan to make sure I’m saving time and money while staying on track to graduate?

A little planning up front can help you avoid an extra semester—or year—of tuition and living expenses.

3. Choose Campus Jobs That Give You More Than a Paycheck

A part-time job can help with expenses, but some jobs do even more.

During college, I worked as a tour guide and in the campus call center. These roles paid me, helped me build skills, and were flexible with my schedule.

If you’re eligible, look into becoming a Resident Assistant (RA)—a position that often includes free housing and meals. That alone could save $10,000–$15,000 a year.

Some schools offer major tuition discounts for employees. If full-time work is part of your plan, a university job might be a smart move.

Visit your campus career center early. They can help you find flexible, well-paying jobs that fit your schedule and goals.

4. Avoid Loans for Groceries and Rent

Tuition is only part of the cost of college. Many students end up borrowing money for things like housing, food, or transportation. That can make loan totals grow quickly.

Whenever you can, use summer or part-time earnings to cover living expenses instead. One student I met takes out only what she needs for tuition and uses her summer income to pay off her loans before interest kicks in. She expects to graduate with less than $10,000 in debt.

Look for ways to reduce costs: live with family, become an RA, or split rent with roommates. Every dollar you don’t borrow is one you won’t have to repay—with interest—later.

5. Save Big on Books and Materials

Textbooks are often surprisingly expensive—but you have options.

I saved by borrowing from the library, trading with classmates, and asking professors for extra copies. In one class, I even used professional development funds from my job to purchase books that counted for both work and school.

Try this script:

Hi Professor, I’m trying to keep my college costs down. Do you have an extra copy of the textbook I can borrow, or know if the library has one available?

Even saving $100 per class adds up fast.

Final Thoughts

Earning your degree is one of the best investments you can make—but that doesn’t mean you have to go broke doing it.

With a few smart strategies and a willingness to ask for help, you can make college more affordable, reduce your student loan burden, and start your career on solid financial ground. You’ve got this.

You Might Also Be Interested In…

Welcome, Freshman: A College Guide to Credit SuccessWelcome, Freshman: A College Guide to Credit Success

GreenPath Financial Service

Resources for Students and Graduates

If you’re starting college or is now repaying your student loans, take a look at these resources from GreenPath. These resources can help you plan for a financially healthy future.