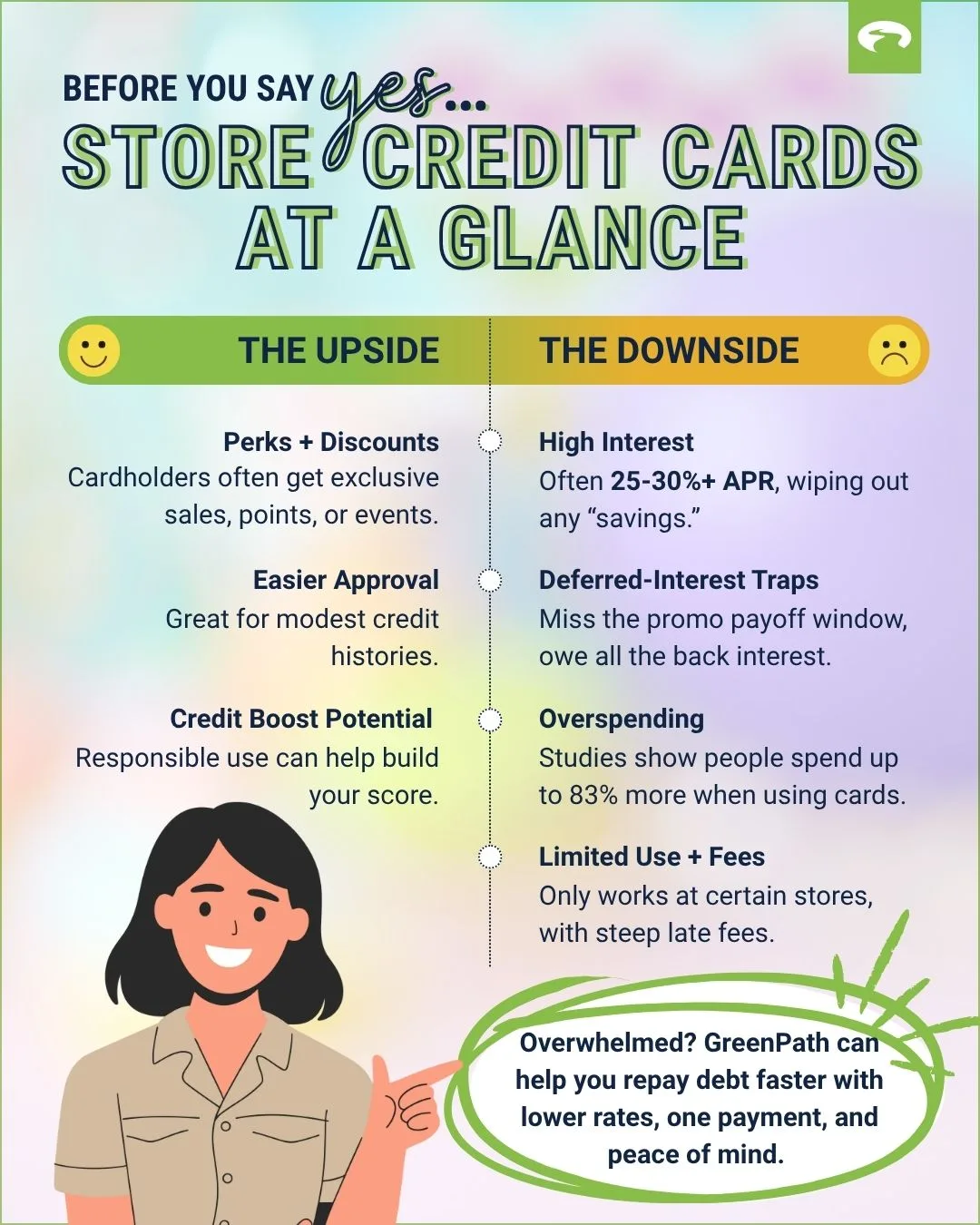

A store credit card can offer fun perks and discounts — as long as you always pay the full balance each month.

If you carry a balance, you’re probably looking at much higher interest rates than with general-use cards — and that can wipe out any “savings.”

If store credit cards ever feel like a burden, a debt-management programdebt-management program can help you repay debt over 3 to 5 years, typically with lower rates.

The holidays are comingholidays are coming, and you’ll probably see plenty of alluring offers promising “instant 20% off” or “bonus points” if you open a store card in checkout lines or while you’re filling your online cart. It feels tempting —like free money during a season when every dollar counts! But before you say yes to another card, it’s worth taking a closer look at what’s really going on behind the scenes.

The Reality: Credit Cards Are Dominating

- Plastic is still king when it comes to spending. In 2024, credit and debit cards accounted for 35% of consumer payments by number (with cash down to just 14%).

- Meanwhile, the average credit-card debt among cardholders who carry a balance is $7,321 in Q1 2025 — up ~5.8% year over year.

Consumers aren’t just using cards to earn rewards or rack up perks — they’re leaning on them to make ends meet. When the holidays add extra pressure to spend, it’s easy for “a little debt” to snowball into something that follows you long after the decorations come down.

Pros of a Store Credit Card

- Better perks at that store. You may get higher points, bigger discounts, special events, or flexible return terms if you’re a “cardholder.” Retailers often reserve the best deals for their own cardholders.

- Easier to qualify. Store cards often approve people who might not pass for a general credit card, especially if your credit history is modest.

- Credit-building potential. When handled responsibly (on-time payments, low utilization), using store cards can help your credit mix and show that you can manage various types of credit.

Cons (And Why Many People Regret Saying Yes)

- Sky-high interest rates. A store-only credit card often carries an APR well above many general-purpose cards. Some retail cards average interest rates above 25%–30%.

- Deferred-interest traps. Some offers say “no interest if paid in 12 months,” but if you don’t pay off the full balance by the deadline, you can be charged interest retroactively.

- Temptation to overspend. Because you’re being rewarded for using the card, it’s easy to rationalize purchases you wouldn’t make in cash. (One MIT-backed study found people spend up to 83% more when paying by card vs. cash.)

- High fees and narrow usage. Late fees, over-limit fees, and usage restrictions (only in certain stores or with certain partners) can make these cards more costly.

- Credit score risk. Opening a new card triggers a credit inquiry, and carrying a high balance or missing payments can hurt your scorehurt your score. Also, some store cards may have lower credit limits, which makes utilization creep up faster.

Smart Decision Checklist

Before you accept a store credit card offer this holiday season, pause and run through these:

| Question | Why It Matters |

| Will I definitely pay off the balance in full (not just “maybe”)? | If not, you may pay more in interest than you gain in discounts. |

| How high is the APR (offered and after any intro period)? | Compare it with your best credit card; the difference can be huge. |

| Are the perks worth giving the card exclusive business? | Only take the card if it fits your shopping habits for the store. |

| Do I already have several cards open? | Additional hard inquiries and credit line changes can affect your credit mix. |

| What’s my fallback plan if I can’t pay? | That’s where a debt-management strategy becomes relevant. |

When to Walk Away (and When to Seek Help)

If your gut says this card is adding more risk than reward — or if you already have credit card balances that stress you — it might be time to skip the retail offer. Remember: a holiday purchase is nice, but peace of mind lasts longer.

If store card debt starts piling up, you don’t have to manage it alone. GreenPath provides free financial counselingfree financial counseling and a Debt Management Program (DMP)Debt Management Program (DMP) designed to help you pay off unsecured debt in 3–5 years, with lower interest rates and consolidated payments. On average, DMP clients spend $199 less in monthly payments and pay off debt seven years sooner.

You Might Also Be Interested In…

What You Will Learn

- How to use BNPL responsibly and integrate it into a healthy financial plan

- Common pitfalls to avoid when using BNPL to stay on track with your financial wellness goals

- Insights from GreenPath Financial Wellness Experts who provide coaching and counseling on managing short-term credit tools like BNPL

GreenPath Financial Service

Debt Management Program

GreenPath is a 60-year trusted national nonprofit, learn how GreenPath’s Debt Management Program can help you pay off your debt in 3-5 years, while helping you develop sound financial literacy.