Your Credit History: There’s Always a Path Forward

- November 2, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Credit

Rebuild credit with GreenPath’s expert guidance. Learn strategies like paying on time and using credit builder loans.

Millions of Homeowners Aren’t Refinancing, Despite Big Potential Savings. Here’s What’s Holding Them Back – TIME NextAdvisor

- October 29, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: News

Excerpt from TIME NextAdvisor discusses the pros and cons of refinancing a mortgage, with insight from Financial Wellness Expert, Katie Bossler. Read the full article. Nearly 14 million homeowners could save money by refinancing their mortgage, but some common concerns are holding them back. “It’s good to just do...

The Budgetnista Talks “Next Level Adulting”

- October 26, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Savings

A Virtual Conversation Earlier this year, GreenPath hosted a special streaming event “The Financial Transformation You’ve Been Waiting For!” It was a virtual conversation featuring Tiffany “The Budgetnista” Aliche. In this video highlight, The Budgetnista gives practical advice about next level “Adulting”...

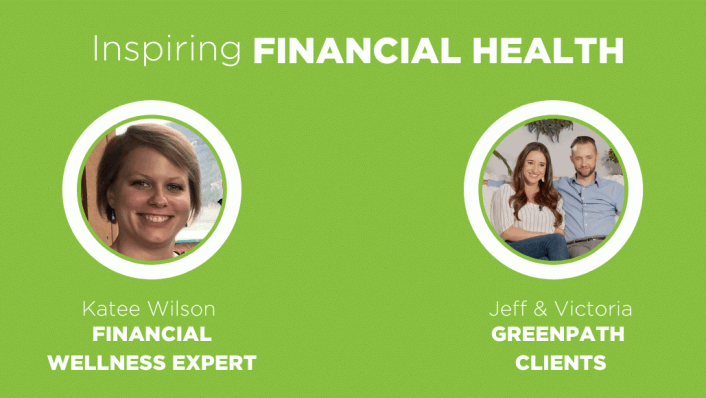

How One Family Increased Their Financial Health and Inspires Others to do the Same

- October 25, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: People Behind GreenPath

GreenPath Financial Wellness Expert Katee Wilson is a GreenPath Financial Wellness Expert based in Fort Collins, Colorado. She began working with GreenPath in 2015. Katee’s favorite part about working at GreenPath is the difference the nonprofit organization makes in people’s lives. The work she does with clients...

Why Online Financial Education Pays Off

- October 22, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Budgeting, Credit, Debt

Thanks to ever increasing technology and access to information via the web, apps, and interactive connectivity , we now have the ability to learn, grow and conduct our financial business at our fingertips. That includes the recently launched GreenPath Learning Lab - a free, self-paced online learning portal designed...

7 Tips to Get Smart About Credit

- October 21, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Credit

You have a great opportunity to assess your financial situation and make a plan to move forward. If you are dealing with credit and debt, you aren’t alone. The average American household has an average balance of about $6,600 in credit card debt, and that’s not taking into account home, auto, and student loans....

What to Know About Changes to Public Service Loan Forgiveness

- October 19, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, College

Many Borrowers with Student Debt Many borrowers with student debt were relieved to learn about changes to the public service loan forgiveness program, announced in October 2021. Because of past confusion and complexity about eligibility, recently the Department of Education announced an overhaul of the Public Service...

The Budgetnista Talks Credit Scores

- October 18, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Credit

When The Budgetnista presented a virtual conversation earlier this year, one of her topics was about credit scores. As The Budgetnista notes in the video highlight below, your credit score is a number based on a formula using the information in your credit report. The result is an accurate forecast of how likely...

Take Control of Your Finances

- October 14, 2021

- By: Greenpath Financial Wellness, GreenPath Financial Wellness is a trusted national nonprofit with more than 60-years of helping people build financial health and resiliency. Our NFCC-certified counselors give you options to manage credit card debt, student loans and homeownership.

- Category: Blog, Budgeting, Credit

Taking Control of Your Finances is Easier Than You Might Think Getting started can seem challenging, but creating a financial plan, putting aside some savings, and keeping an eye on your credit report is proven to jump start you on the road to financial success. You may ask yourself, “How do I take control of my...

Showing results 37-45 out of 144