Paying your bills on time is the most significant factor in maintaining a good credit score, helping you secure better loan terms and interest rates.

Keeping your credit utilization below 30-40% and paying down debtpaying down debt can significantly boost your credit score and financial health.

GreenPath’s certified counselors offer personalized guidance and strategies to help you understand your creditunderstand your credit and make informed financial decisions.

As you’re probably already aware, your credit score can impact your financial picture across several categories. Lenders evaluate your score in determining whether you’ll be approved for a loan or credit card, what interest rate they’ll charge, and even whether you’ll be eligible for job or security clearance.

If you need to give your credit a boost, we have five suggestions for helping you get back on track. But first! the basics.

What is a Credit Score?

A credit score uses historical information about a person’s past use of credit to calculate the likelihood that they will pay back what they owe on time and in full. Ranging from a low of 300 to a high of 850 (sometimes referred to as “perfect credit”), credit scores are calculated based on payment history, amount owed, length of credit history, types of credit used, and new applications for credit.

In general, a score of 660 and above would make a borrower eligible for credit with favorable interest rates. A score below 600 may result in difficulty getting approved for credit and is likely to be subject to high-interest rates.

If you don’t know your credit score, you might be able to find it on your bank or loan statement or credit card bill. You are entitled to receive a free credit report annually from each of the three major credit reporting agencies.

Current Credit Report Figures

Average Credit Score in the U.S.: 715 (as of 2024)

Average Credit Score by Age:

- Generation Z (18-25): 681

- Millennials (26-41): 691

- Generation X (42-57): 709

- Baby Boomers (58-76): 746

- Silent Generation (77+): 760

Impact of Credit Scores on Financial Decisions

- Loan and Credit Card Approvals: Higher credit scores increase the likelihood of being approved for loans and credit cards. Maintaining credit card accounts in good standing can positively influence your credit score and improve your chances of approval. For example, a person with a score of 750 may secure a mortgage with a 3.5% interest rate, while someone with a score of 620 might get a 5% rate, resulting in higher monthly payments.

- Interest Rates: Better credit scores typically lead to lower interest rates on borrowed money. A diverse credit mix, including credit cards, auto loans, and mortgages, can enhance your creditworthiness and potentially lead to better interest rates. For instance, a car loan for someone with a score of 700 might have a 4% interest rate, whereas a score of 580 could result in a 9% rate.

- Renting and Utilities: A good credit score can make it easier to rent an apartment or set up utilities without hefty deposits.

- Employment Opportunities: Some employers check credit scores as part of their hiring process, especially for positions that require financial responsibility. Regularly reviewing your credit reports can help you identify and correct any inaccuracies that might negatively impact your score.

Strategies for Improving your Credit Score

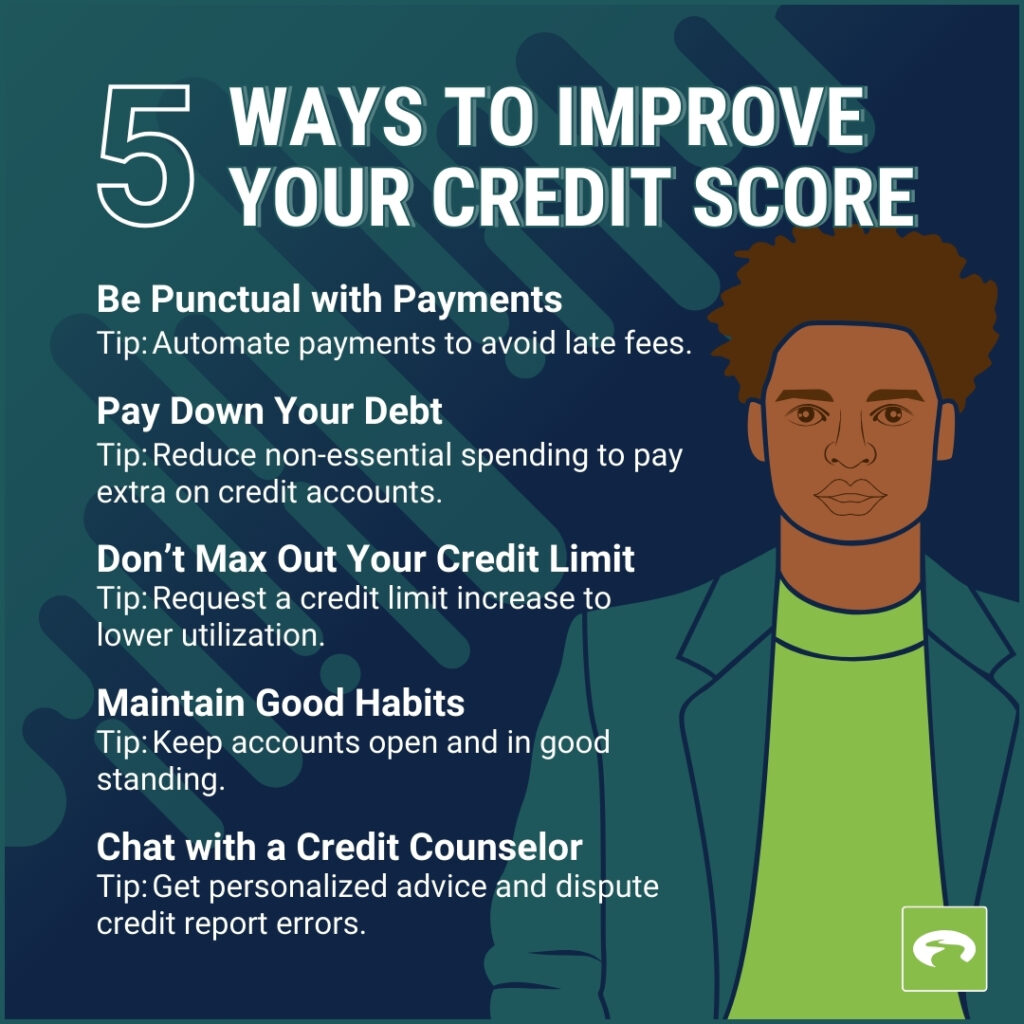

1. Be punctual with payments.

Paying your bills on time is the biggest single factor used to calculate your credit score. Consistent on-time payments can significantly boost your creditworthiness. Late payments, past due accounts, and accounts in collections have a negative impact on your credit. Always aim for consistent, timely payment (even if it’s the minimum amount). Punctuality pays off: a positive payment history across 18 months or longer increases the likelihood that you’ll receive more favorable loan terms from lenders.

If you’re falling behind, be proactive in your financial planning. Create a monthly budgetmonthly budget that accounts for bills and everyday expenses like gas and groceries. Struggling to keep track of multiple bills? Consider automation. Automated payments can minimize late fees. If you know you will miss a due date, call your credit card company or lender. They may be able to help by moving your due date out.

2. Pay down your debt.

How much you owe is another big factor when it comes to credit score calculation. Carrying a high credit card balance can negatively affect your score, so it’s important to pay down your debt. If you have a large amount of debt or are carrying balances on credit accounts for extended periods of time, it can negatively affect your score.

Make it a goal to pay down your debt. Take inventory of any categories where you can reduce non-essential spending so that you pay a little extra on your credit accounts. A credit counselor can walk you through different options for dealing with debt and may be able to help you pay it off more quickly.

Transform your finances with GreenPath’s expert support. Take charge of your money starting now.

800-550-1961877-337-33993. Don’t max out your credit limit.

The amount of credit you use (also called credit utilization) also affects your score. Requesting a credit limit increase can lower your overall credit utilization and potentially improve your score. Aim to use less than 30-40% of your available credit. Spending above that threshold or carrying high balances relative to your credit limit will cause your score to fall. If you are using more of your credit limit than you would like, consider adjusting your budget and spending choices to reduce your overall reliance on credit.

Keep in mind that regularly utilizing small amounts of credit (and paying it off) will increase your score. People without established credit history typically receive lower credit scores.

Consider using a secured credit card. Consider using a secured credit card to build or rebuild your credit. This type of card requires a cash deposit as collateral and can help establish a positive credit history through on-time payments.

4. Maintain good habits.

Your credit score is built on patterns over time, with an emphasis on more recent activity. Building a positive credit history through responsible credit management is crucial for long-term credit improvement. Improving credit and rebuilding a credit score that has fallen will take some patience, but it can be done! Credit scores can and do change.

A history of prompt payments and accounts that you have held for five years or longer has a positive effect on your credit score. Quickly opening multiple accounts, carrying high balances for a sustained period, or even closing unused accounts have a negative effect on your score.

Events like foreclosure and bankruptcy, while they serve an important purpose for those with severe debt, have a significant and lengthy impact on your credit score. If you are considering one of these options, we encourage you to consult a legal professional and to investigate other alternatives as well.

5. Chat with a credit counselor.

While talking to a certified credit counselorcertified credit counselor won’t have an immediate effect on your credit score, you can gain valuable insight and information. A credit counselor can help you identify and dispute credit report errors that may be affecting your score. They will listen without judgment, work with you to optimize your financial situation, and create a personalized plan to eliminate high interest debt.

You Might Also Be Interested In…

Understanding Your Credit Report and Score Understanding Your Credit Report and Score

What You Will Learn

- What impacts your credit report and credit score

- Why credit is important

- Tips to improve your credit score

GreenPath Financial Service

Free Debt Counseling

Take control of your finances, get tailored guidance and a hassle-free budgeting experience. GreenPath offers personalized advice on how to manage your money.