A high debt-to-income (DTI) ratio can make it harder to secure favorable loan or interest rates but understanding and managing your DTI can help improve your financial situation.

You can lower your DTI by increasing your income, paying down debt, and budgeting, which can gradually move you closer to your financial goals.

GreenPath’s Debt Management ProgramDebt Management Program offers a supportive and judgment-free way to reduce your debt burden, helping to simplify payments and lower your DTI over time.

The number crunchers over at the Federal Reserve monitor how much of the nation’s disposable income goes toward household debt payments. As it turns out, the average American is spending almost 10% of their monthly income on debt payments. (Surprised? Neither are we.)

Dealing with a high debt-to-income (DTI) ratio is stressful. Especially for those who are shelling out an even higher percentage of their monthly paychecks. But what exactly is DTI? And what can you do if your ratio is keeping you awake at night?

Understanding Debt-to-Income Ratio

The debt-to-income ratio (DTI) measures how much of your monthly income goes toward paying off debt. To calculate a debt-to-income ratio, add up your monthly debt payments (like your mortgage, car loan, credit cards, or student loans) and divide that number by your gross monthly income. Multiply by 100, and you’ve now got your percentage.

Let’s say Sarah is trying to calculate her DTI before applying for a loan. Here’s a breakdown of her monthly bills and income:

Rent: $1,200

Student loan: $300

Credit card payments: $400

Gross income: $5,500

Sarah’s total monthly debt payment is $1,900:

$1,200 + $300 + $400 = $1,900

For her DTI ratio, she divides her total debt payments by her gross income:

$1,900 ÷ $5,500 = 0.35

Sarah’s debt-to-income ratio is 35%.

Why Does DTI Matter?

Lenders look at DTI when deciding whether you can handle more debt. The 28/36 rule is a guideline for determining a healthy DTI. It suggests spending no more than 28% of gross monthly income on housing and no more than 36% on total debt payments. If DTI is too high, loan approval could be more difficult, or higher interest rates might be offered, which is not going to do you any favors when it comes to saving for the future.

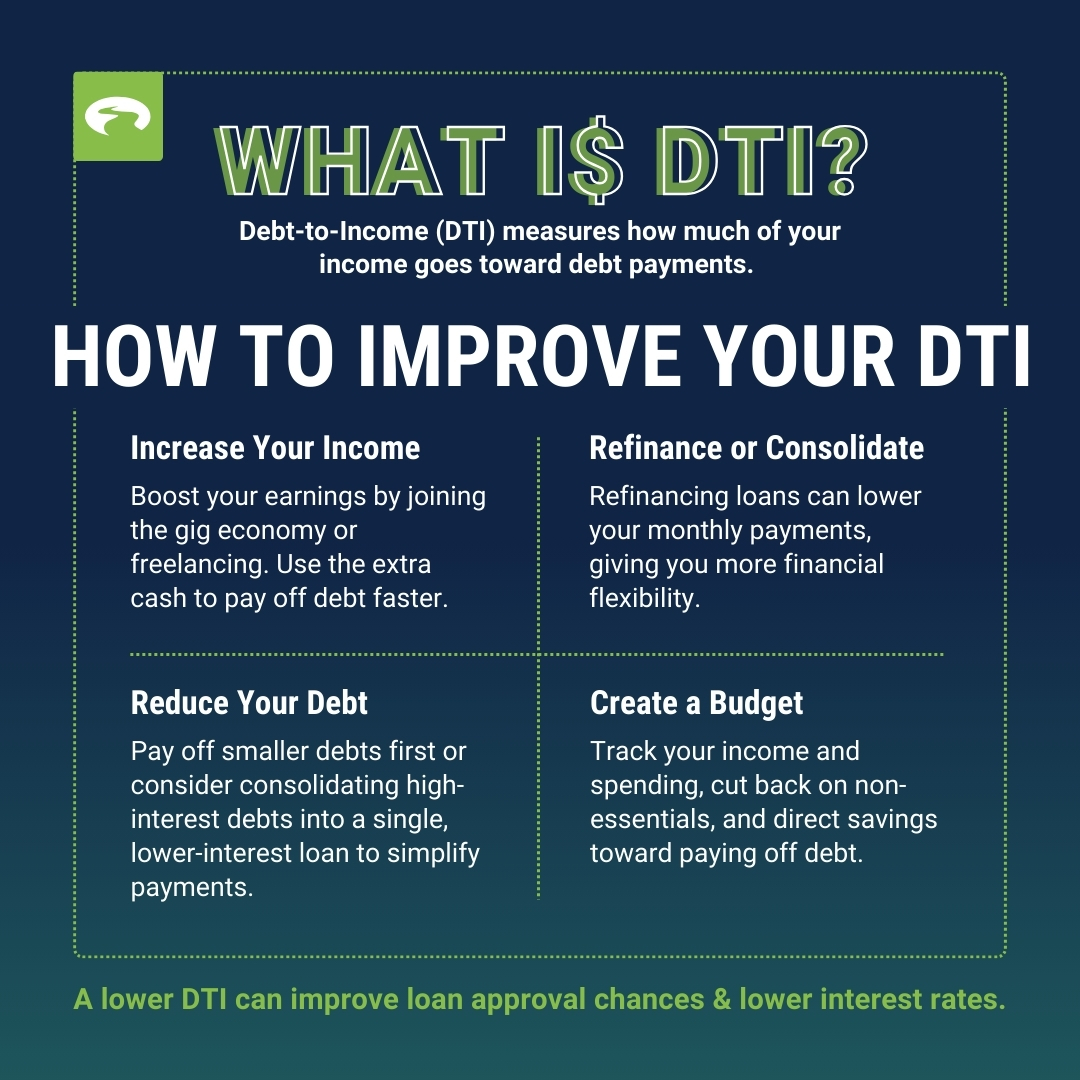

How Can You Lower Your Debt-to-Income Ratio?

With an onslaught of recent political headlines, you may have missed a story about federal court decisions on the Saving on Valuable Education (SAVE) Plan. As of this publishing, StudentAid.gov has this statement on their website:

There are a few ways to lower DTI, and while it can take time—and probably some frustration along the way—remind yourself that each small step you take is progress made.

- Increase Your Income

Freelancing, selling items online, or joining the gig economy are a few ways to bring in additional earnings. Even small side-hustles can make a difference. Maybe you deliver groceries in your neighborhood and use the extra income to pay off a small credit card balance quickly. You’ve now reduced your DTI and improved cash flow. - Reduce Your Debt

Focus on paying off smaller debts first or reducing high-interest balances. For those with multiple high-interest payments, debt consolidationdebt consolidation for a high debt-to-income ratio might be one solution. By consolidating debt into one lower-interest loan, monthly payments become more manageable, which helps reduce DTI over time. - Refinance or Consolidate

By refinancing your mortgage, student loans, or auto loans, you can reduce the monthly payments and free up some breathing room in your budget. On the same front, consolidating credit card debt into a single loan with a lower rate simplifies your payments, allowing you to tackle your debt more efficiently. - Create a Budget

Start by listing all your monthly income and expenses to see where your money is going. Then, look for areas where you can cut back or downgrade subscriptions on non-essential spending, such as food delivery, streaming services, or subscriptions. Direct the money saved toward paying off your debts faster. By sticking to a budgetsticking to a budget, you can slowly reduce your DTI.

Common Questions About Debt-to-Income Ratio

Can You Use a Personal Loan to Pay Off Debt?

Yes, a personal loan can be used to pay off debt, especially if high-interest credit cards are involved. However! Before you go this route, you’ll want to compare interest rates and fees to make sure the personal loan is a better deal than the current debt—because the last thing you want to do is add to your existing financial burden.

Does Lowering Your Debt-to-Income Ratio Raise Your Credit Score?

Although DTI doesn’t directly impact a credit scorecredit score, lowering it can still help in the long run. Paying off debt reduces credit utilization, which is a major factor in credit scores. Over time, this can lead to improvements in both DTI and credit scores.

How Can You Get Out of Debt with a Low Income?

Even with a limited income, it’s possible to work toward becoming debt-free. Focus on making small, consistent payments and finding ways to trim or renegotiate discretionary expenses.

Exploring options like a Debt Management ProgramDebt Management Program can also help by lowering interest rates and simplifying payments. By consolidating payments into one easy-to-manage plan, it becomes possible to reduce DTI and work toward financial comfort.

GreenPath Financial Service

Free Debt Counseling

Take control of your finances, get tailored guidance and a hassle-free budgeting experience. GreenPath offers personalized advice on how to manage your money.