44% of Americans report finding at least one error on their credit reportcredit report, emphasizing the importance of reviewing yours regularly.

Disputing a credit report error can be completed in a few steps and following up after you report the error is key to ensuring your credit report stays accurate.

Have questions about disputing an error? Jump to our Frequently Asked Questions as a quick reference guide.

How to Dispute a Credit Report

A recent survey from Consumer Reports reveals that 44% of Americans have found at least one error on their credit report. These mistakes can seriously affect your credit score, making it harder to get approved for loans or credit cards, or even causing higher interest rates.

Thankfully, you can dispute these errors and correct them. If you’re not sure where to start, you’re entitled to one free credit report every year from each of the three major credit bureaus through AnnualCreditReport.com. Checking your report regularly helps you catch mistakes early, before they affect your credit too much.

Why You Might Need to Dispute a Credit Report

There are several reasons why you might need to dispute a credit report. Maybe a lender reported a late payment you made on time, or perhaps there’s an account listed that isn’t yours. These errors can happen, but when they do, it’s important to act quickly to get them removed.

Some of the most common credit report errors include:

- Incorrect account information (like a missed payment that never happened).

- Outdated personal details (such as old addresses or incorrect names).

- Accounts you don’t recognize, which could be a sign of identity theftidentity theft.

The Impact of These Errors

These errors can really add up! Just one mistake might drag down your credit score, making it more expensive to borrow money. It can even affect other areas of your life, like getting approved for an apartment or a job that requires a credit check. That’s why it’s important to fix these errors as soon as you spot them.

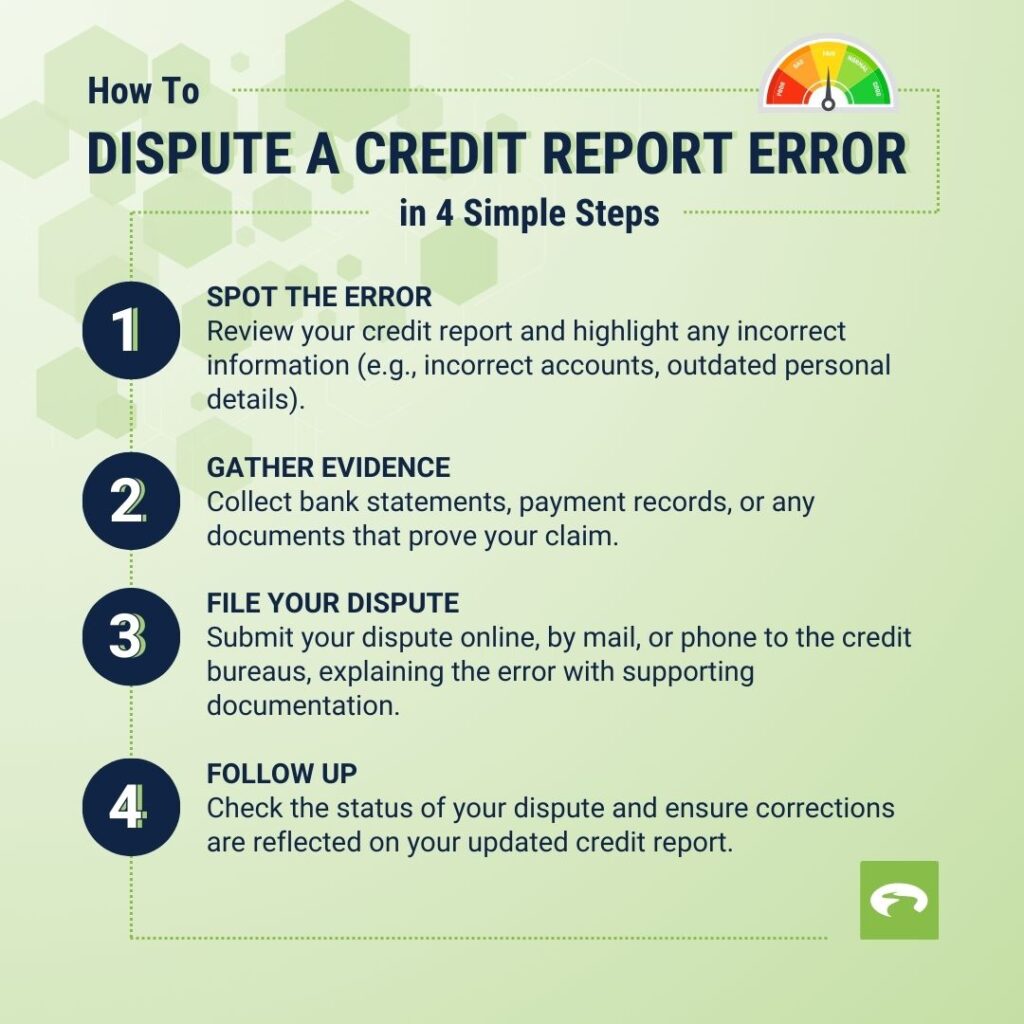

Steps to Dispute a Credit Report

Once you’ve found an error on your credit report, disputing it is a straightforward process.

- Gathering Necessary Documentation

Start by gathering up your evidence—this could be payment receipts, bank statements, or anything else that proves the error. The more proof you have, the stronger your case will be. - Contacting Credit Bureaus

Next, you’ll need to contact the credit bureaus—Experian, Equifax, and TransUnion—to officially dispute the error. Most people choose to do this online, but you can also submit disputes by mail or over the phone. Be sure to include all your supporting documentation and clearly explain the mistake. - Following Up on Your Dispute

After filing your dispute, credit bureaus have about 30 days to investigate. Make sure to follow up during this time to see how things are progressing and keep a record of any responses. If more information is needed, respond quickly to avoid delays.

Frequently Asked Questions About Disputes

It’s normal to have questions about what to expect and how the process works. To help ease your concerns, we’ve answered some of the most common questions people have when disputing credit report errors.

- Does disputing hurt your credit?

Nope! Disputing a credit report error does not hurt your score. In fact, correcting an error might even help boost it in the long run. - Will my credit score go back up after a dispute?

If the error was dragging down your score, correcting it should help your score improve. The exact amount of the improvement will depend on how the mistake impacted your credit. - How long does the dispute process take?

The investigation process typically takes up to 30 days. However, if the credit bureau needs more information, it could take a little longer. - Can you legally remove things from your credit report?

You can’t remove accurate information from your credit report, but you can legally dispute and remove any errors. It’s your right to have a credit report that reflects your true financial history. - What documents will I need to provide for my credit report dispute?

You’ll need to provide supporting evidence that proves the error is incorrect. This might include account statements, payment receipts, copies of your credit report, or any other documents that back up your claim. Be as detailed as possible to speed up the process. - What should I expect after filing a credit report dispute?

Once you’ve filed a dispute, the credit bureaus have 30 days to investigate. You’ll receive updates from the bureaus, and they’ll notify you of the outcome. If your dispute is successful, the incorrect information will be removed or updated. - What can you dispute on your credit report?

You can dispute any information that you believe is inaccurate, incomplete, or outdated. This includes incorrect payment histories, account balances, personal information (like names or addresses), or accounts that don’t belong to you.

What to Expect After Disputing

Once you’ve submitted your dispute, the credit bureaus complete their investigation and notify you of the outcome.

If the error is negatively affecting your score, correcting it should help your credit score improve. Be aware that it might take a little time for the change to be reflected across all three credit bureaus.

Once your dispute is resolved, request a new copy of your credit report to confirm the correction. Moving forward, it’s smart to review your report regularly. And we can help! GreenPath’s Virtual Financial CoachVirtual Financial Coach offers cost-free, judgment-free advice. Whether you want to optimize credit utilization, understand your credit report, or strategize long-term savings, she’s here to help—24/7 on any device.

GreenPath Financial Service

Free Debt Counseling

Take control of your finances, get tailored guidance and a hassle-free budgeting experience. GreenPath offers personalized advice on how to manage your money.